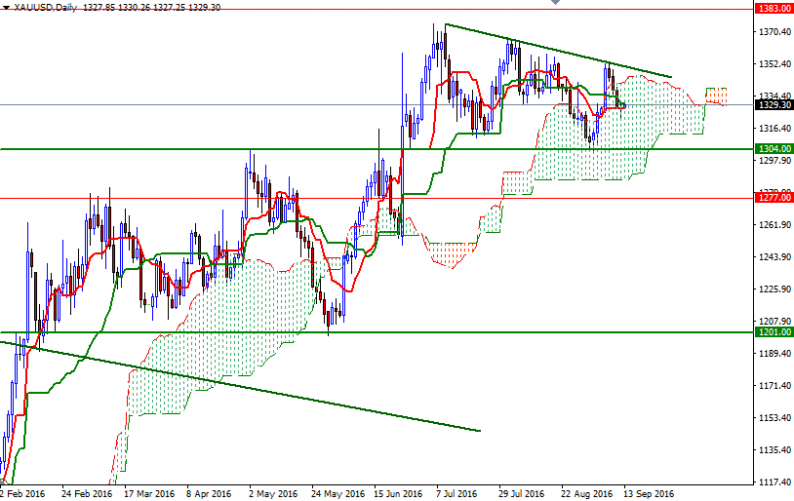

Gold started the week on the back foot but recouped losses as investors’ concerns about interest rates eased following dovish comments from a Federal Reserve official. The XAU/USD pair initially tested the support at 1320 as expected, before bouncing back to the current levels. Aside from technical buying, a pullback in the U.S. dollar helped push the precious metal slightly higher.

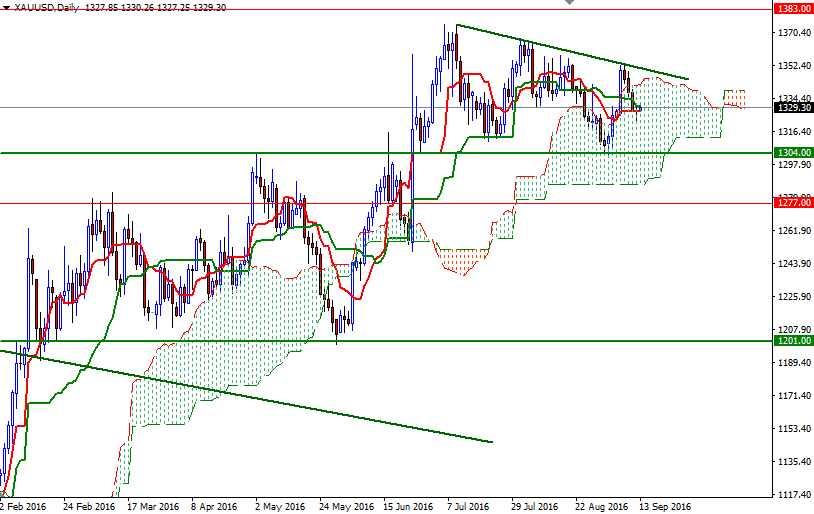

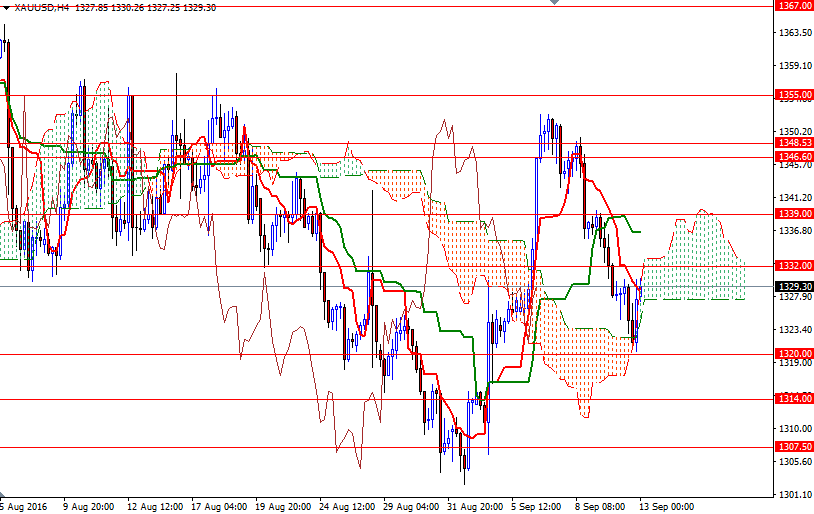

It appears that the market is headed towards the 1332 level which is the first hurdle bulls have to jump. Technically, moving inside the Ichimoku clouds (on both the daily and 4-hourly charts) suggests that the short term trend is flat and the pair is looking for a direction. If prices can break above 1332, then we are likely to proceed to the next barrier in the 1340/39 zone. The bulls have to push prices above 1340 so that they can challenge the bears in the 1348.50-1346.60 area

To the downside, the initial support stands in the 1326-1324.50 region, followed by 1320/19. If the market dives below 1319, the XAU/USD pair might retreat towards the 1314 level. Eliminating this support would imply that the bears will be targeting 1310 afterwards. A successful break below 1310 would make me think that the market is getting ready to test the key support in 1304/0.

Leave A Comment