Gold prices rose 1.3% on Tuesday, breaking a two-day losing streak, as declines in global stock markets drew buyers to the perceived safety of the precious metal. Equity markets around the globe slid after investors took a cautious stance ahead of the release of the Fed’s minutes. The Fed is due to publish minutes from its March policy meeting at 18:00 GMT.

Federal Open Market Committee speakers we heard over the past couple weeks highlighted the contrasting views for rate hikes.

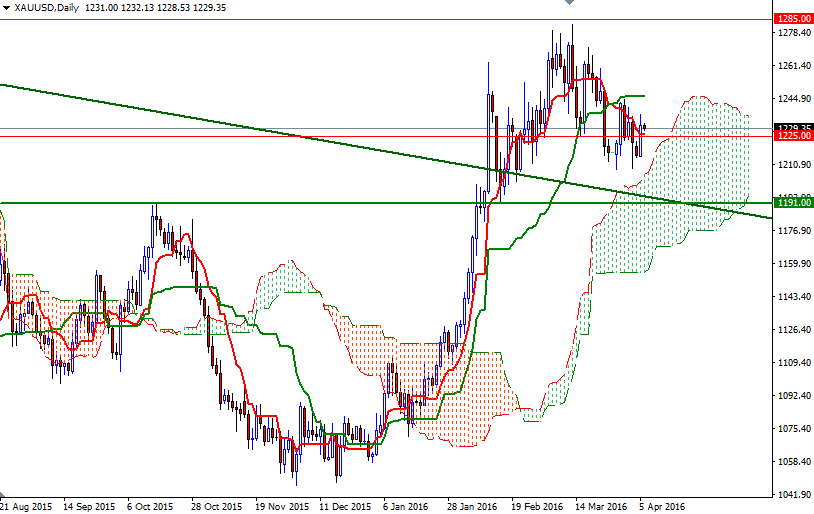

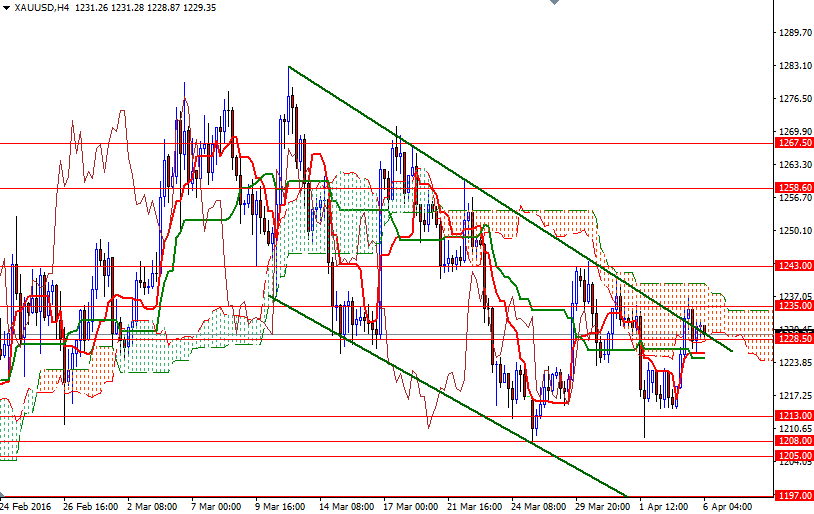

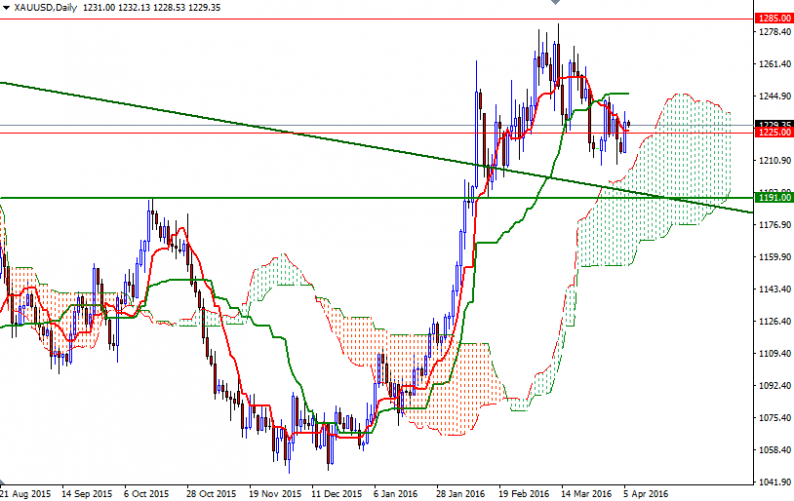

The XAU/USD is currently trading at $1229.35 an ounce, slightly lower than the opening price of $1231. Trading during the Asian session has been quiet and it seems that the market will tread water until the until the U.S. session. Residing within the boundaries of the Ichimoku cloud on the 4-hour chart also suggests that prices will be range bound over the short-term.

From an intra-day perspective, the key areas to watch will be 1228.50-1225 and 1237.60-1235. If the bulls overcome the resistance in the 1237.60-1235 region, they will probably set sail for 1243 afterwards. Climbing above the 1243 level would lure more investors into the market and increase the possibility of a bullish attempt to revisit 1248. However, if the market dives below 1225, then 1221/0 could be the next stop. Breaking down below 1220 could add to pressure on prices and eventually drag XAU/USD back to the 1215/3 support.

Leave A Comment