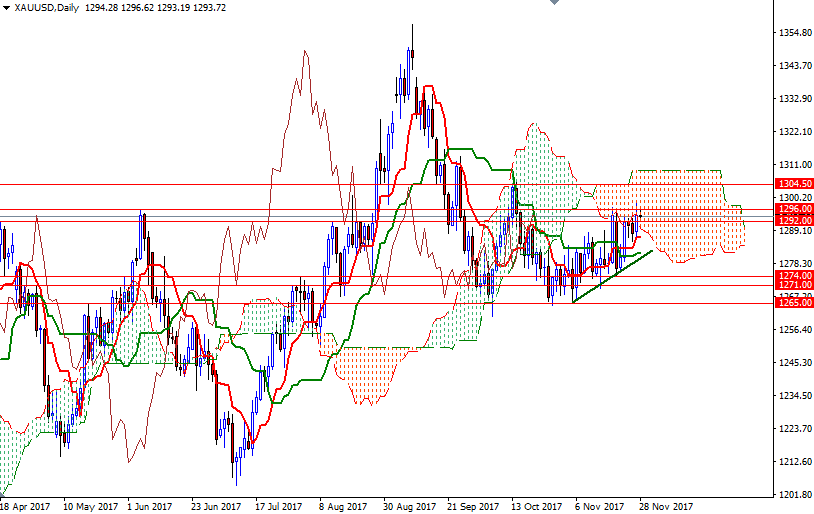

Gold prices rose $5.39 an ounce on Monday, supported by a weaker U.S. dollar. The greenback rose slightly against the euro but dropped against the Japanese yen and the British pound. XAU/USD extended its gains after the resistance at $1292 was broken, but was unable to hold above the $1296 level. As a result, the market headed back to the $1292 area.

Trading above the 4-hourly Ichimoku clouds and positive Tenkan-sen (nine-period moving average, red line) – Kijun-sen (twenty six-period moving average, green line) on the charts suggest that the bulls still have the technical advantage. However, also note that prices are within the borders of the daily cloud and there is a lack of strong momentum. With that in mind, I wouldn’t rule out the possibility of a pull back towards the 4-hourly cloud.

The bears will need to drag prices below 1292/1 to test the support in the 1288/7 area. If this support gives way, the market will be targeting 1283/2 next. The bulls, on the other hand, have to lift prices above the 1296.80-1296 in order to visit 1302-1300. A break through there brings in 1304.50. If XAU/USD closes above 1304.50 on a daily basis, then the 1309 level (the top of the daily cloud) will be the next target.

Leave A Comment