Gold prices advanced 2.1% on Thursday, extending their gains to a second straight session, as the dollar came under pressure after durable goods orders data fell short of market expectations. The Commerce Department said orders for durable goods fell a seasonally adjusted 2% in August. The XAU/USD pair accelerated its advance after penetrating the $1141.31 resistance level and traded as high as $1156.60.

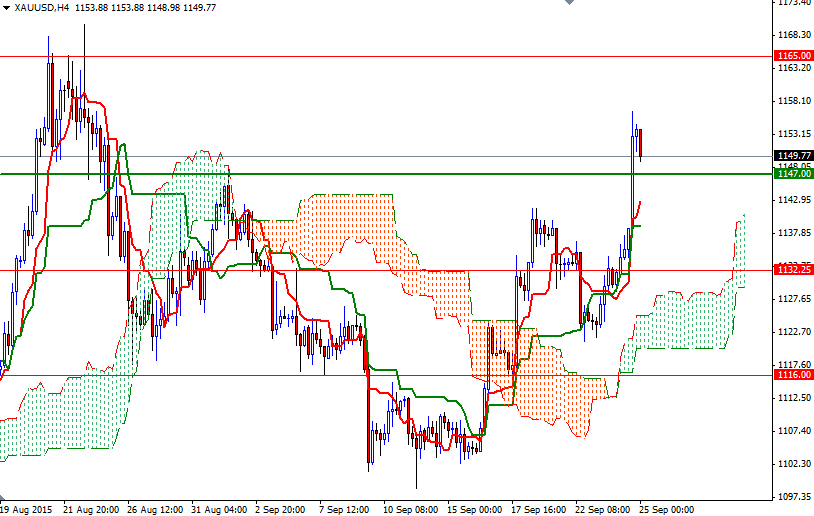

Yesterday’s surge in gold altered the medium term outlook as the market penetrated the daily Ichimoku cloud and also closed beyond the 1147 level which played an important role in the past. Plus, we have a bullish Tenkan-sen (nine-period moving average, red line) – Kijun-sen (twenty six-day moving average, green line) cross. Technically, trading above both the daily and 4-hourly time frames should give an advantage to the bulls.

Click on picture to enlarge

However, it seems that the inability to pass through the 1154.62 resistance puts some pressure on XAU/USD. Because of that, I will keep an eye on the 1147 level. If the bulls manage to defend this area, we may see XAU/USD retesting the 1154.62 level. As I said in my previous analysis, clearing that resistance is essential for a bullish continuation towards 1165. On the other hand, if the market can’t hold above the 1147 level, then prices will probably retreat to the 1141.31 level which happens to be the top of the daily cloud. Closing back below 1141.31 would imply that the bears will be aiming for 1134.35 – 1132.25.

Click on picture to enlarge

Leave A Comment