Gold prices settled at $1065.96 per ounce, falling nearly 0.7% over the course of the week, as the Fed’s rate hike decision dulled demand for the precious metal. The XAU/USD pair traded as low as $1047.64 an ounce on Thursday but recovered a portion of losses on safe-haven bids prompted by a sell-off in global equities on Friday. Federal Reserve Chair Janet Yellen stressed her confidence in the health of the U.S. economy but also said “As the outlook evolves, we’ll respond appropriately. I strongly doubt that it will mean equally spaced hikes”.

Now that the first hike is out of the way, the focus shifts to the pace of future rate increases and how this affects the greenback. In the meantime, the volatility in equities will certainly be another thing to pay attention because if stocks deepen their losses, it may boost the demand for the precious metal as an alternative investment. On the other hand, higher interest rates in the United States and subdued inflation in advanced economies will probably limit the upside potential of gold prices in the long run. Friday’s data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 13656 contracts, from 19623 a week earlier.

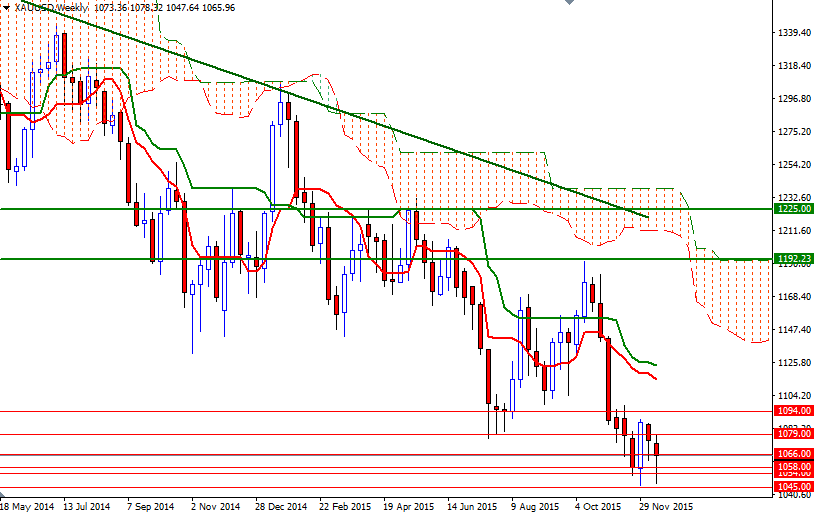

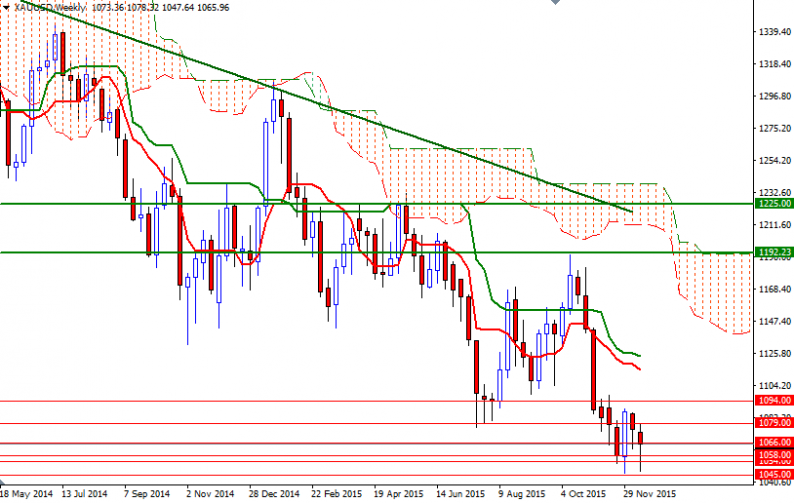

On the weekly and daily time frames, prices remain below the Ichimoku cloud, suggesting that the overall trend is bearish. Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines also support this view. However, the weekly candle which has a long shadow to the down side indicates that buying interest emerges on dips. XAU/USD fell with momentum all the way down to about 1047 but reversed strongly off that support, and we are now back in a choppy area. In order to ease downward pressure, the bulls need to lift prices above the 1068/6 area where the bottom of the 4-hourly Ichimoku cloud resides. If that is the case, I would expect prices to revisit the 1073-1072.32 resistance. A break up above this barrier could trigger a reaction targeting the 1081.55-1079 area. There is likely to be minor support at around 1063/2, followed by a significant one at 1058. If this support is broken, the market will aim for 1055.50-1054. Closing below 1045 on a daily basis would put us back on track with such a scenario eying subsequent targets at 1025 and 1017.

Leave A Comment