Gold is struggling. Gold bulls will tell you that the yellow metal is doing great, as it has gone up since the start of the year, while stocks and most other commodities have come down. That is obviously only part of the story. As fear among investors has exploded in recent weeks, one would expect gold’s fear trade character to manifest itself. So far, the fear trade has been contained.

Gold’s trend is still down, until proven otherwise. Our chart tells a clear story: after a consolidation period in 2012 and a trend change (see in red on the chart below), gold has been moving in a clear trend channel. Since last January, the yellow metal has failed to even test its resistance line.

So the question really is what we can derive from the leading indicators in the precious metals complex.

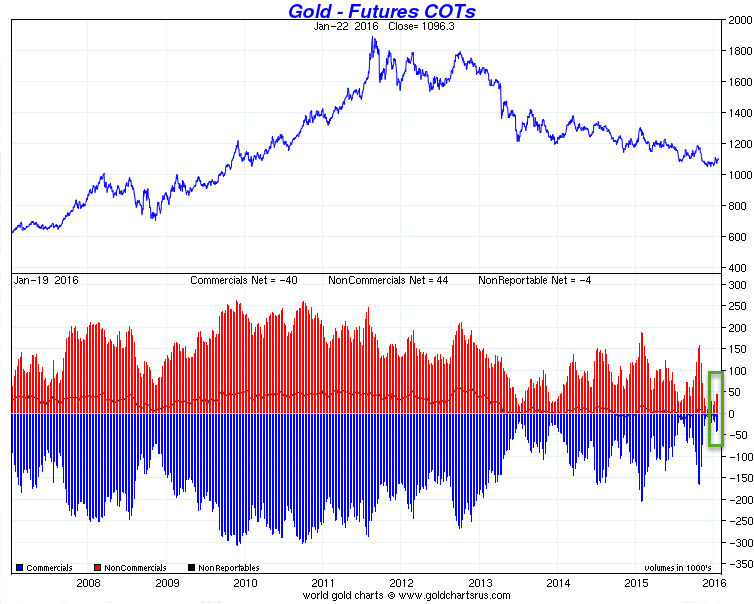

One of the indicators, according to our methodology, is the futures market structure, particularly the short positions of commercial traders. In order to understand the underlying dynamics, we use an analogy: the faster commercial net short positions increase, the more stopping power they create to cap a rally. In that context, one can clearly see in the lower pane of the next chart how commercial traders are capping rallies as every time gold’s price nears resistance (since 2012). Readers can do the exercise by comparing the peaks since 2013 on the chart above, and see how that coincides with peaks in net short positions of commercial traders on the chart below (blue bars, lower pane).

Today’s futures positions are still relatively low, and the rate of change is low as well, as indicated with the green rectangle. We interpret this as ‘there is sufficient upside potential’ but probably within the boundaries of the downtrend. We will not get excited about gold until it proves able to break out of its trend channel.

One sidenote: it could be an encouraging sign for gold bulls that commercial traders need increasingly more stopping power (read: higher short positions) to cap the rallies, a trend started in the summer of 2013. We don’t read too much in that trend, at least not yet, but we keep a close eye on it.

Leave A Comment