Gold ended slightly lower Thursday, marking the first loss in five sessions, as the dollar strengthened on the back of the stronger-than-expected U.S. inflation and jobless claims data. The XAU/USD pair traded as low as $1174.35 an ounce after the Labor Department said its core consumer price index rose 0.2% in September and the number of people filing new claims for unemployment benefits dropped by 7K to 255K.

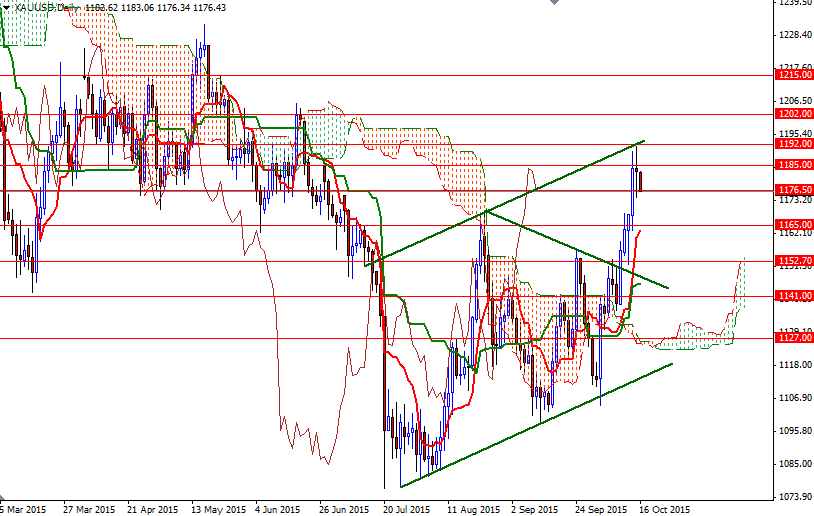

Gold prices edged down in Asian trade, moving away from a three-and-a-half-month high struck yesterday. The market’s inability to penetrate the barrier at the 1192 level (where a horizontal resistance and the upper band of a short-term ascending channel coincided) is also behind today’s decline. As I warned in my previous analysis, there is significant resistance between the 1185 and 1192 levels and therefore it is essential to anchor somewhere above 1192 for a bullish continuation towards the weekly Ichimoku cloud.

Click on image to enlarge

XAU/USD is testing the support around the 1176.50 level at the moment. If prices reverse from here and the 1185 resistance is surpassed, the XAU/USD pair may continue to the upside and make another assault on 1192. Closing above 1192 could pave the way towards the 1200/2 zone where the bottom of the weekly clouds currently sits. To the downside, the bears have to clear nearby supports such as 1176.50 and 1171.60. If the 1171.60 level (the Kijun-sen on the 4-hour chart) gives way, it is quite possible that the XAU/USD pair will extend its losses, targeting the 1165/3 region.

Click on image to enlarge

Leave A Comment