Gold prices ended Wednesday’s session up $3.80 an ounce, extending their gains to a third-straight session, after Federal Reserve Chair Janet Yellen signaled a cautious approach to further monetary tightening. Yellen said the Federal Reserve will need to keep gradually raising interest rates in the coming years, but not to levels seen in previous rate cycles. XAU/USD traded as high as $1225.64 but gave up some of earlier gains as a rally in equities weighed on the market.

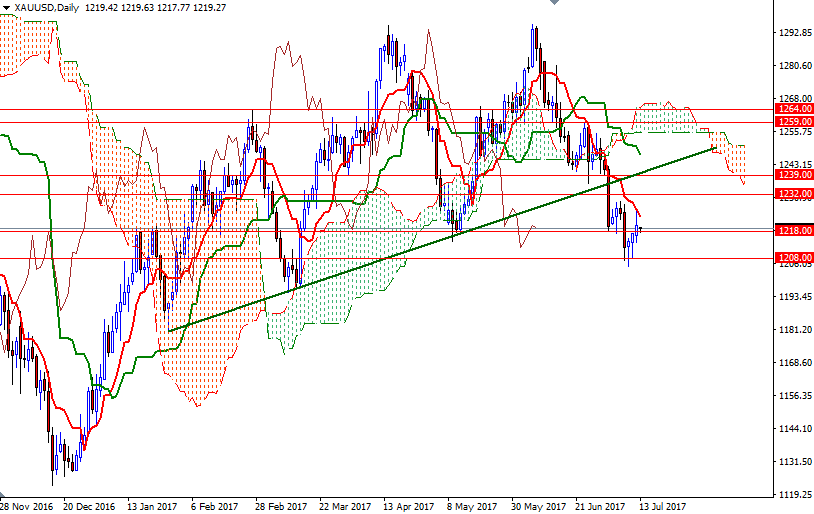

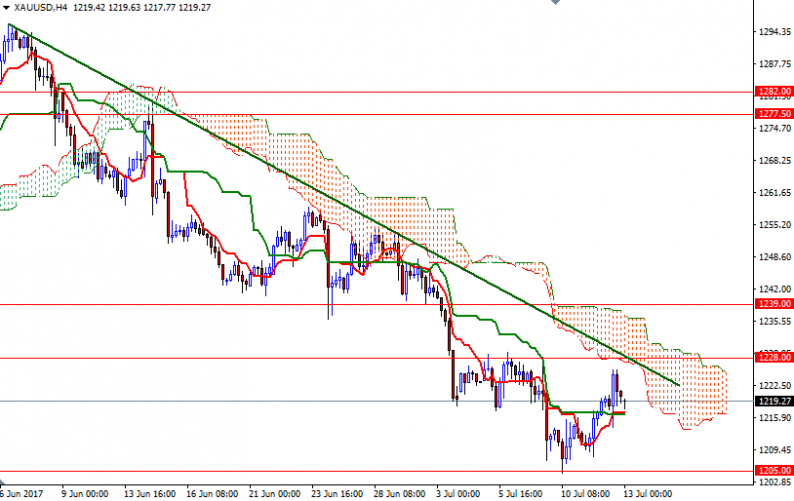

XAU/USD is still trading below the daily and the 4-hourly Ichimoku clouds, suggesting that the downside risks remain. However, as I pointed out yesterday, prices are above the clouds on the H1 and M30 charts. It appears that the market is going to attempt to penetrate the 4-hourly cloud today but the area at around the 1228 level may be tougher than the bulls imagine as it is confluent with a short-term bearish trend line. If this resistance is broken, the market will be aiming for 1232 and 1239.

To the downside, keep an eye on the 1218/6 area, where the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) converge on the H4 chart. The bears have to capture this strategic camp in order to revisit 1213/11. Right below there, the 1208/5 area stands out as an obvious key support. Closing below 1205 on a daily basis implies that the 1197/4 zone will be the next stop.

Leave A Comment