For some downtrodden items, that is. A downturn in the GSR and its fellow horseman the USD could provide some relief for the markets that have done the most poorly since Uncle Buck’s up turn over the summer.

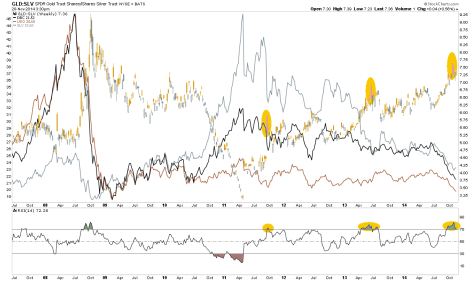

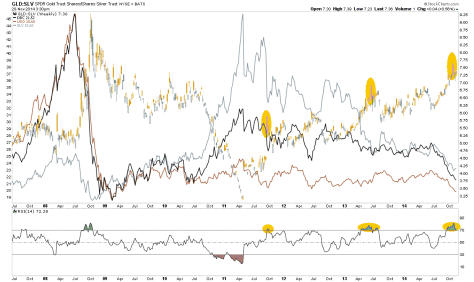

In other words, the deflation story may need to take a rest for a while if GSR and USD correct. What I find interesting, other than the over bought weekly GSR, is those big reversal candles that have marked highs and been followed by declines. If silver rebounds vs. gold an inflationary blip could manifest. But then I’ve been watching for that for quite a while now.

Apologies in advance for the confusing look to the chart, but the point is that silver, oil and commodities have been nose diving during the latest rise in GSR, because it was attended by the 2nd horseman. If – and it’s of course still an ‘if’ – the horsemen take a break a lot of these things are going to rally, possibly conveniently along with a post-tax loss seasonal play.

Leave A Comment