Gold snapped seven consecutive days of gains as investors grew cautious ahead of Federal Reserve Chair Janet Yellen’s appearance before the House Financial Services Committee. Failing to sustain a push above the $1193/1 region also weighed on the market. The XAU/USD pair tried to hold beyond this barrier yesterday but stalled as some investors used this opportunity to cash in gains from a recent rally to a 7-1/2-month high. As a result, prices closed just below the $1191 level.

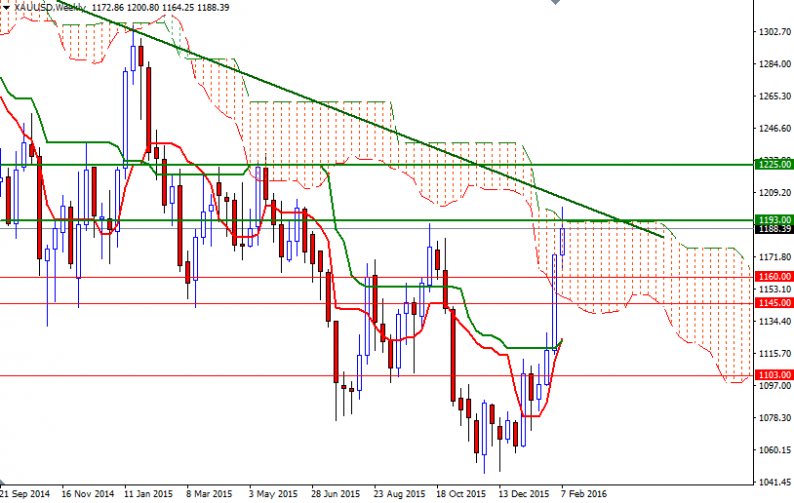

Fed Chair Yellen is scheduled to deliver her semiannual report to Congress on the outlook for the U.S. economy. Her remarks could provide insight into the pace of future rate hikes. We will probably have to wait for her testimony before prices get anywhere interesting. Technically speaking, the daily and 4-hourly charts are bullish while the XAU/USD pair is trading above the Ichimoku clouds. In addition to that, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are positively aligned and the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices on almost all charts.

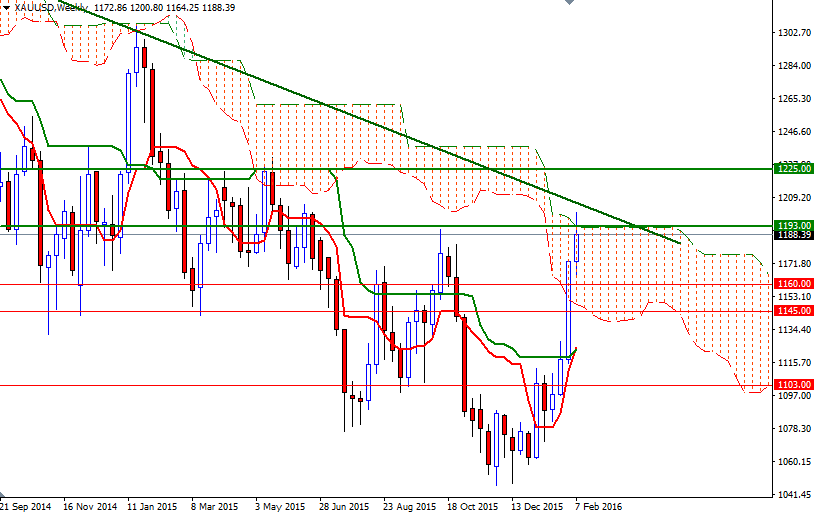

However, as you can see on the weekly chart, the area between the 1193 and 1225 levels has been troublesome in the past so it would not be surprising to see this area offering significant resistance – especially around the 1213 level where the long-term bearish trend line originating in 2013 and a horizontal resistance converge. From an intra-day perspective, I will keep an eye on 1200 and 1186/3. If the bulls penetrate the resistance at the 1200 level, I think the market will proceed to 1205. They will need to capture this strategic point in order to challenge the bears at the 1213 battle field. A failure, however, will likely result in new liquidations and the support around 1186/3 will be tested. If this support is broken, then the 1179 level will be the next stop. Closing below 1179 would suggest that the bears are getting ready to tackle 1171 (or even 1164/0).

Leave A Comment