Gold prices drifted lower on Wednesday, erasing most of the gains made in the previous session, and settled at $1071.12 an ounce as the dollar strengthened. This after a batch of upbeat U.S. economic data reinforced the case for the Federal Reserve to hike interest rates in December. The Labor Department said the number of people filing new claims for unemployment benefits dropped by 12K to 260K. Separate reports from the Commerce Department showed sales of new homes jumped 10.7% in October, while orders for durable goods climbed 3%.

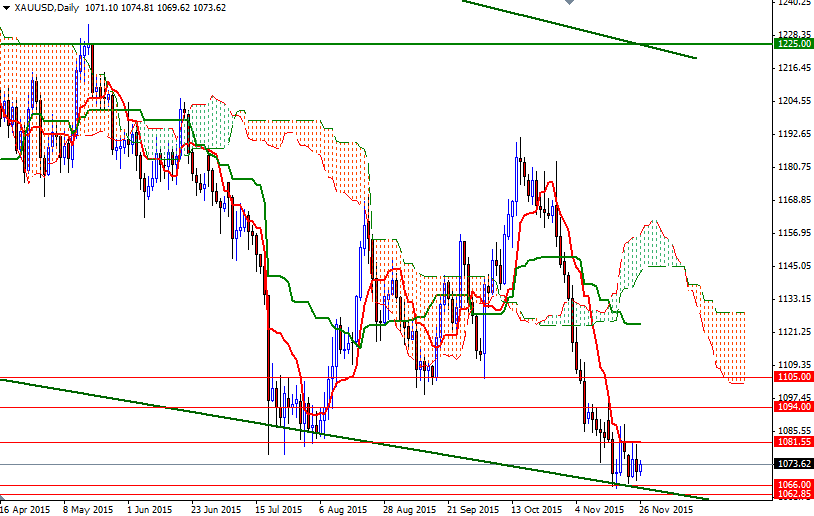

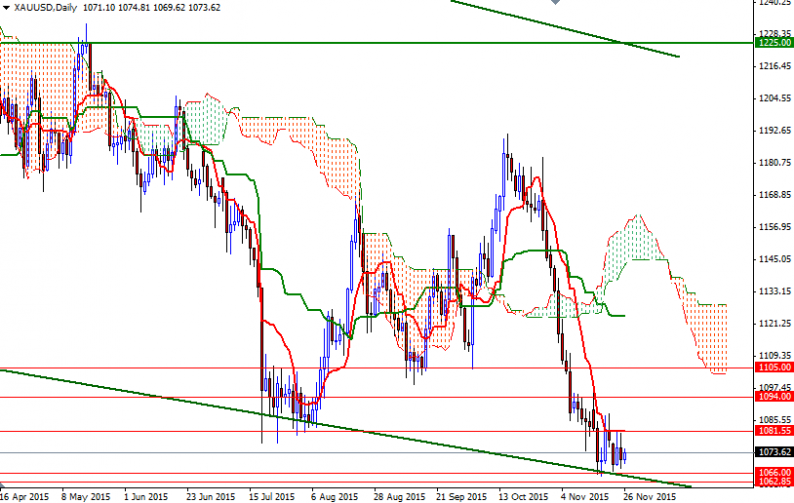

We have been locked in a tight trading range of 1066 to 1081.55 so short term traders should pay attention to these levels. Markets in the United States will be closed due to Thanksgiving holiday today and trading during the Asian session seems quite muted already. Meanwhile, we are coming closer and closer to the corner of a narrowing triangle.

The XAU/USD pair will need to break either above 1081.55 or below 1066 in order to gain some momentum. If the bulls take the reins and push prices beyond the Ichimoku cloud on the 4-hour time frame, they may have a chance to tackle the resistance at 1087.A daily close behind this level would indicate that the market is heading towards 1094. However, bear in mind that the odds favor further downside while the market trades below the weekly and daily Ichimoku clouds. If the 1066 support is broken, XAU/USD will probably test 1062.85/1.55 afterwards. A sustained break below 1061.55 would make me think that prices will fall to the 1054 level before finding some support.

Leave A Comment