Gold prices rose to the highest level in nearly four weeks on Tuesday as geopolitical risks and weakness in the greenback bolstered the precious metal’s appeal. In economic news, the Richmond Fed’s manufacturing index came in weaker than expected with a print of 20 in December, down from the previous month’s 30 and below expectations for a reading of 22. World stock markets are mixed today in quieter, post-holiday trading.

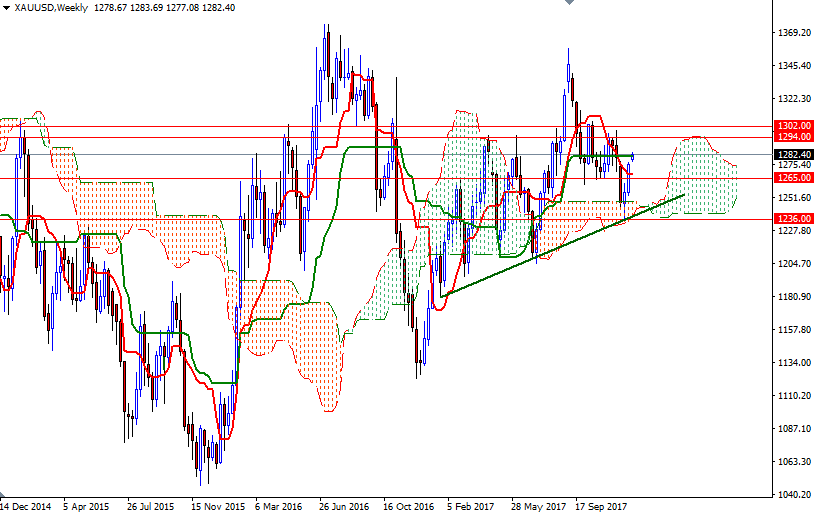

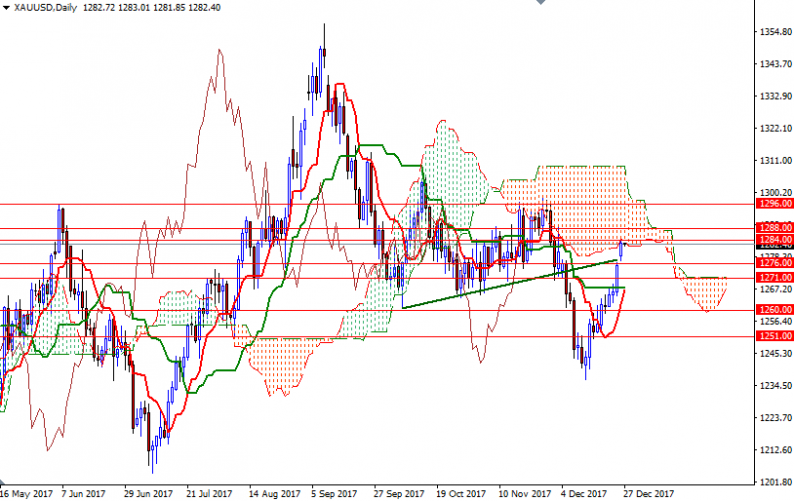

XAU/USD continues to trade above the Ichimoku clouds on the 4-hourly and the hourly charts. In addition, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen sen (twenty six-period moving average, green line) are positively aligned on both time frames. The near-term technical outlook has been bullish since prices penetrated the 4-hourly cloud and got back above the 1263 level.

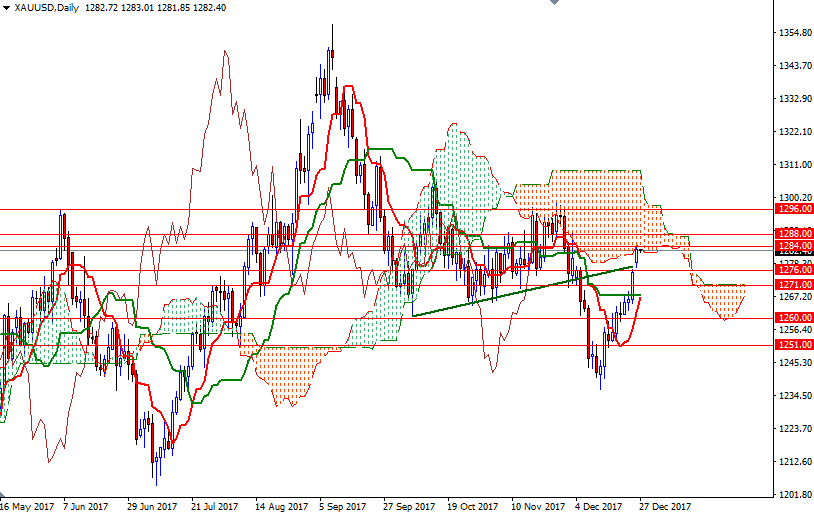

From a chart perspective the first upside barrier comes in at 1284. The bulls will have to eliminate this barrier to proceed to 1288. A daily close above 1288 would suggest that the 1296/4 area might be the next stop. However, if the daily cloud prevents the market from going higher and prices drop back below 1279.50-1278.50, it is likely that we will visit the support in the 1276/5 area. Breaking down below this support could foreshadow a fall to 1273.60-1271.

Leave A Comment