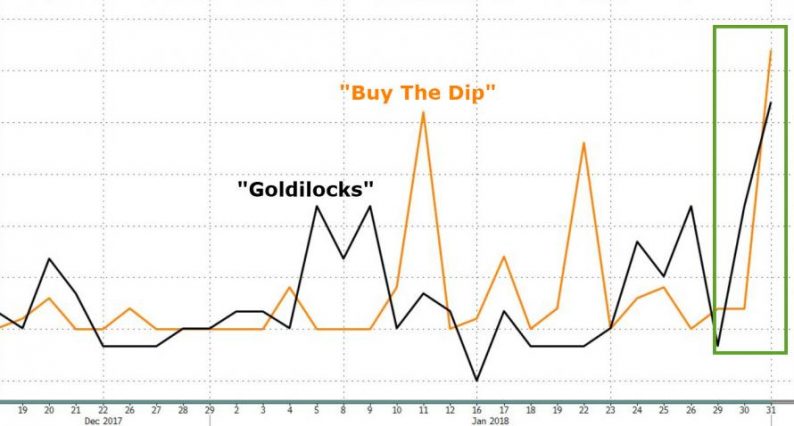

Remember January’s “Goldilocks” market?

Well it’s gone…

Video length: 00:00:03

The Short-Vol trade implosion has now spread to the rest of the world and all other asset classes.

China had one of its ugliest weeks ever…

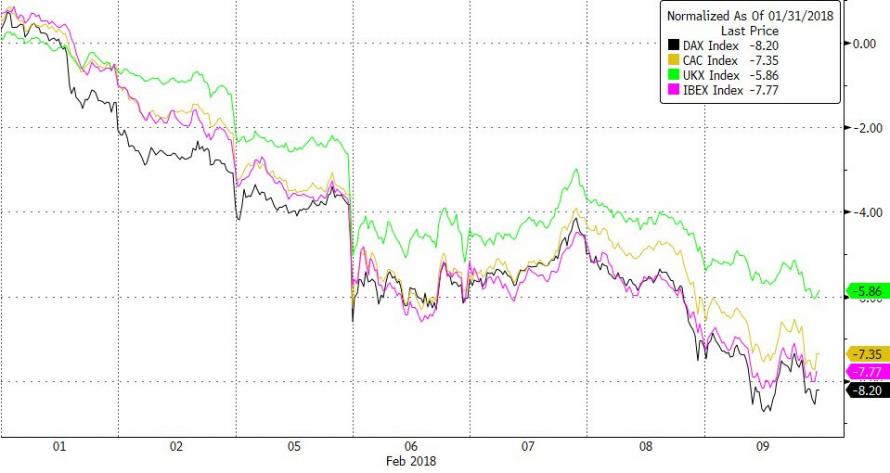

Europe was ugly…

But US equities were a bloodbath…even wuith the sudden mysterious buyer of last resort who panic-bid stocks up (after the S&P broke below its 200DMA)…

Dow futures were lifted 100 points off the lows today…

Also of note is that this panic-bid lifted the major equities out of correction…

Stocks were on target for their worst week for US equities since Lehman in Oct 2008… (worst 2-week drop since Feb 2009)

But after the S&P hit its 200DMA, everything bounced miraculously…

The Dow saw well over 12,000 points worth of intraday swings this week…

This the worst swing in momentum… ever…

And the biggest swing in equity flows ever…record inflow 2 weeks ago to record outflow from equity funds this week

Risk started to spread to other asset classes too…

The biggest drawdowns so far:

Leave A Comment