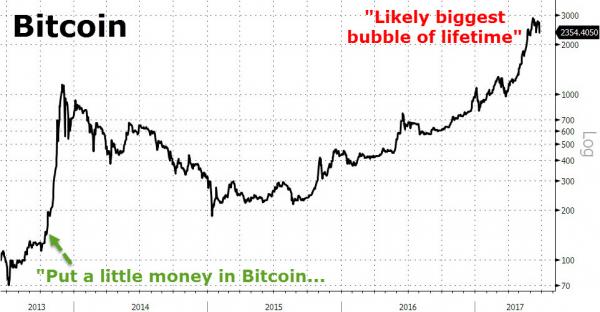

Last week former Fortress Principal Michael Novogratz made headlines in the cryptocurrency world when he told attendees at the CB Insights Future of Fintech conference that he has cut holdings (in Bitcoin and Ethereum) after the cryptocurrencies’ latest “spectacular run,” warning that “Euthereum had likely hit its highs for the year,” and “cryptocurrencies were likely the biggest bubble of his lifetime.”

However, while this all sounds rather downbeat, Novogratz said he remained very “positively constructive” on the space overall, as he should: he still has 10% of his net worth invested in the sector. And, as Bloomberg reported, Novogratz says cryptocurrencies “could be worth north of $5 trillion in five years – if the industry can come out of the shadows.”

So fast forward to Sunday evening Goldman’s chief technician, Sheba Jafari, issued only his second forecast of where Bitcoin is headed next which may accelerate Novogratz’ crypto price target.

Recall, that as we first reported three weeks ago, Jafari said that “due to popular demand, it’s worth taking a quick look at Bitcoin here” and warned that “the market has come close (enough?) to reaching its extended (2.618) target for a 3rd of V-waves from the inception low at 3,134.” He concluded that he was “wary of a near-term top ahead of 3,134” and urged clients to “consider re-establishing bullish exposure between 2,330 and no lower than 1,915.”

He was right: on the very day his note came out, both bitcoin and ethereum hit their all-time highs and shortly after suffered their biggest drop in over two years.

So what does Jafari thinks will happen next? According to the Goldman technician, Bitcoin is now “in wave IV of a sequence that started at the late-’10/early-’11 lows. Wave III came close enough to reaching its 2.618 extended targets at 3,135. Wave IV has already retraced between 23.6% and 38.2% of the move since Jan. ‘15 to 2,330/ 1,915.”

Leave A Comment