By Mark Melin

Systemic risk that was recently dormant is stirring, noted an economics research piece from Goldman Sachs. As credit spreads spike and pressure on bank equities has been building for weeks, it all just might be signaling a “reactivation of systemic risk concerns in markets.” That said analysis from Charles P. Himmelberg notes “fewer systemic concerns than credit markets are pricing.”

Yellen: Too Big To Fail still Too Big To Fail

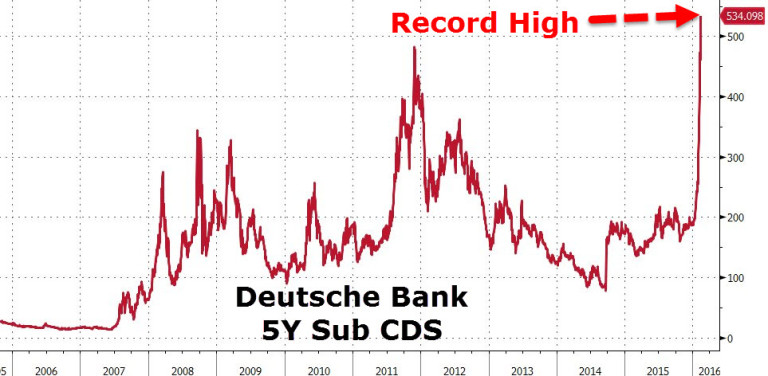

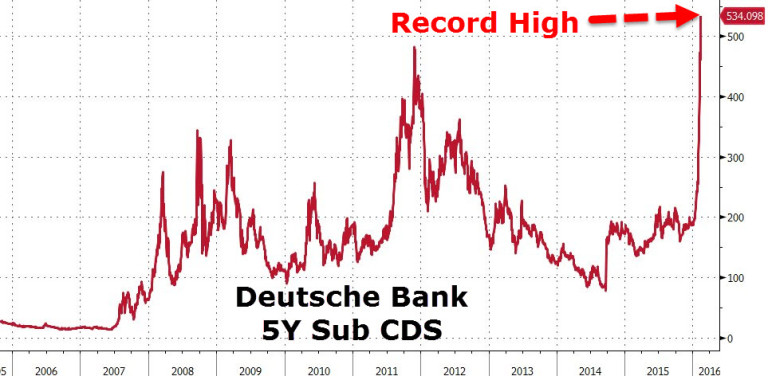

The “systemic concerns” of credit markets are perhaps most emblematic based on the soaring Deutsche Bank credit defaults swaps, which increasingly appear to be pricing in disaster as Fed Chair Janet Yellen says in Senate testimony Thursday the problem of Too Big To Fail has not been solved.

Himmelberg notes that once a market smells fear, the emotion can create a momentum all its own. “We are acutely mindful that systemic fears, once in place, can be self-fulfilling and difficult to reverse,” he wrote. “These systemic concerns, if sustained, would be a new headwind for credit, and risky assets more generally.”

Himmelberg is surprised by the pressure on banks stocks which “mirrors our surprise at the weakness of economic growth more generally” as he looks for higher interest rates.

Deja vu all over again: credit default swaps (CDS) at issue in systemic risk

It is the European credit default swap (CDS) market once again at the center of concern? “We understand why markets might worry. Following the global financial crisis, European banks did not de-lever by nearly as much as US banks.”

Yes, it is the generally unregulated derivatives that were at the center of the 2008 financial crisis once again at the center of big bank concern. “Credit markets are clearly taking note of the systemic risk, and it is certainly unwise to minimize such risks since systemic fears, once in place, can be self-fulfilling and difficult to reverse.”

Leave A Comment