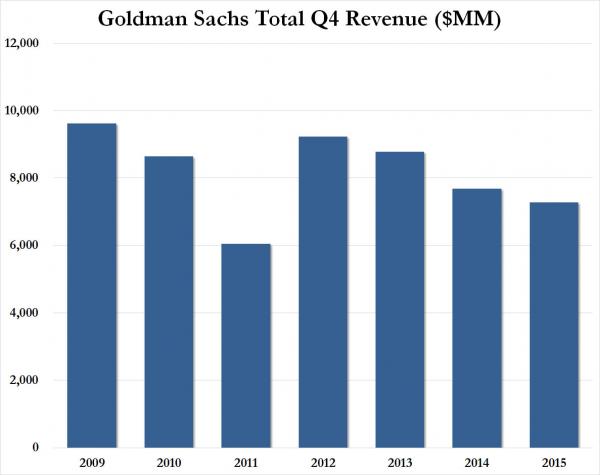

Since looking at Goldman’s (GS) Q4 EPS was going to be a meaningless attempt at comparing apples to oranges due to the bank’s recently announced $3 billion after-tax RMBS settlement, which reduced diluted earnings per common share by $6.53, we decided to instead do what we normally do with Goldman’s earnings report and focus on its top line, where we found that in the fourth quarter the bank had generated only $7.3 billion in revenue, a 5.4% drop from a year ago, and underscoring just how difficult the environment is even for the bank that does god’s work, this was the weakest Q4 revenue from Goldman since 2011.

Looking at the breakdown of the revenue components does not reveal any major surprises, unlike in Q3 when Goldman’s prop trading collapsed:

First the good news: Investment Banking of $1.5 billion was a 7% increase, however was offset Institutional Client flow in FICC of $1.1 billion, down 7.8% while Equities flow revenue of $1.8 billion was also down 9.1%. And while Investment Management revenues of $1.55 billion were largely unchanged, Investing and Lending, aka Prop, once again dropped by 15.4% Y/Y to just $1.3 billion. This is because it is difficult to make money when you control the central banks when not even the central banks have any idea what they are doing.

Finally, while the overall picture continues to deteriorate for Goldman, there was a little piece of good news: the average compensation paid out to Goldman’s 36,800 employees (down 100 from the prior quarter), rose from a multi-year low of $341K to $344,511 as the bank’s compensation margin dipped from 34.3% a quarter ago to just 28.3% in Q4. Then again, we doubt to many Goldmanites this is anything even close to a respectable number.

Leave A Comment