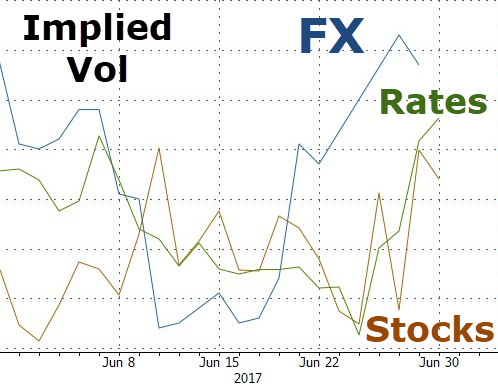

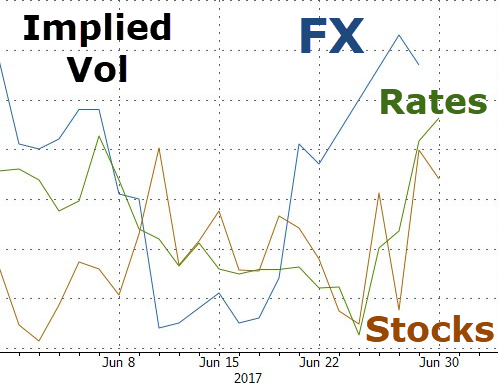

After several months of low volatility across assets since mid-2016, particularly in equities, markets were more volatile last week owing to fears of central bank tightening. Volatility picked up first in FX and rates, and then spilled over to equities. However, as Goldman notes, this might not be the end of the low vol regime yet.

Via Goldman Sachs,

Since 1928, there have been 14 comparable low vol regimes for the S&P 500 – on average, they lasted nearly two years and they had a median length of 15-16 months. Often they were supported by a very favourable macro backdrop, similar to the recent ‘Goldilocks scenario’. Breaking out of the low vol regime usually required a large shock, for example a recession or war. While central bank uncertainty can drive volatility in the near term, it is unlikely to drive a sustained high vol regime.

Investors have recently started to position for higher volatility – the open interest n VIX calls has increased, inflows into the largest long VIX ETP have picked up and the net short on VIX futures has decreased. But the VIX call/put open interest ratio has little predictive power for large VIX spikes historically. We think short-dated S&P 500 put spreads best address the risk investors are facing in the near term – a consolidation but not yet a transition into a sustained higher vol regime.

However, despite the sudden reawakening of fear, Goldman is confident that this is a tempest in a teapot…

Low Vol Regime is Tested But Likely to Prevail

Leave A Comment