Is the marginal equity buyer back?

Two weeks ago, JPMorgan’s Nikolaos Panigirtzoglou asked the following question:

Has the marginal equity buyer gone?

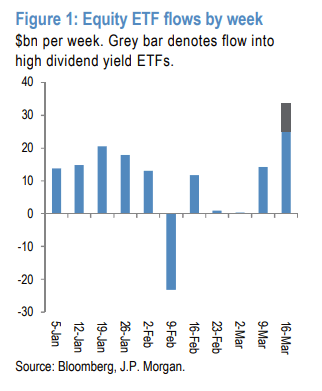

He was of course referring to the retail bid for stocks. Following the rather dramatic outflows that coincided with the February market turmoil, there was some evidence that Joe E*Trader was set to dive back into markets, but subsequent volatility in equity ETF flows through the end of last month cast some doubt on that assumption.

Panigirtzoglou observed that the disappearance of the retail bid could be problematic considering institutional investors’ readily observable hesitancy to rebuild positions quickly in the wake of the shakeout.

“This improvement was important for the bullish thesis, as it will take some time until momentum improves and vol normalizes inducing institutional investors including CTAs and other trend following investors to start building up long equity positions again,” Panigirtzoglou wrote, before clarifying as following: “In other words, we had hoped that retail investors, perhaps induced by ‘buying the dip’ mentality, were emerging as the marginal buyer of equities.”

Additionally, JPM noted that there seemed to be a dearth of market liquidity which Panigirtzoglou suggested could be exacerbated by “restrictions imposed on off exchange trading and dark pools by MiFID II.”

Well in one section of the latest edition of his popular weekly note “Flows And Liquidity”, Panigirtzoglou revisits all of the above and he’s got what seems like good news.

For one thing, the retail bid is back – and “big league”. To wit:

Equity ETFs saw a very big inflow of $34bn this week (Monday to Thursday). This is by far the highest weekly equity ETF flow ever, driven almost entirely by US equity ETFs.

So there’s that. But perhaps more importantly – or at least for anyone who is concerned about underlying trends that have the potential to make dislocations and acute risk-off episodes worse – liquidity has improved. Here’s Panigirtzoglou again:

Leave A Comment