U.S. economic data is softening and volatility remains low as the third quarter gets underway, but for all the activity among favored tech stocks during the second quarter, U.S. equities could only manage a very small gain. A relative calm that seems to have set in, but one firm is warning that investors should prepare for a massive rotation that may be starting.

A rotation to drastically change the market

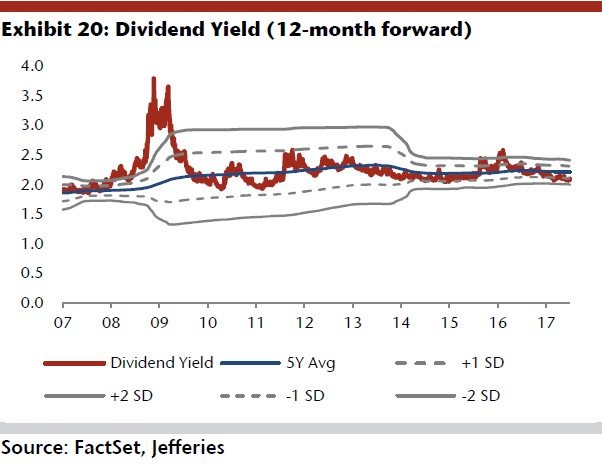

Jefferies Chief Global Equity Strategist Sean Darby and team pointed out in a note dated July 3 that the S&P 500 only rose 2.74% during the second quarter. The Jefferies team added that although both the equity market and the economy are undergoing a “disinflationary boom” of sorts, it would be unwise to become complacent at this time because of the rotation they see starting.

In fact, they feel the rotation that’s starting to take place “could sharply alter the character of the market in the second half of this year. They cite several “non-macro factors” that happen to be occurring at the same time as the yield curve’s flattening.

Some market watchers have been surprised at how much the yield curve in the U.S. has flattened, although many blame President Trump’s inability to deliver on any of his campaign promises. Others blame the decline in economic surprises paired with temporary peaks in expectations for inflation.

However, the Jefferies team feels that what we’re witnessing right now is a twist on the “Greenspan ‘conundrum'” that occurred in 2005. They see the mini taper tantrum that occurred last week following commentary from the European Central Bank’s president as a warning that the bond market’s long side is far more important for stocks than short rates, even though equities are “long duration assets.” They also noted that a rotation has already occurred in some areas.

Leave A Comment