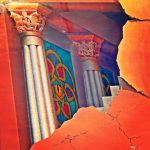

Architectural Order refers to classical styles such as Greek columns.

The Corinthian Order (Greek column) is the most ornate. Elegant, this type of order was used for the top story standing ten diameters high or about 100 feet high.

Second time this year we look beyond the U.S., at the end of March, I featured IFN-the India Fund ETF.

My comment, “Should it (IFN) clear 26.00, it’s possible it can continue its upward trajectory to around 30.00-32.00.”

Today, IFN made an intraday high of 26.92.

With an average trading range per day of around $.20, IFN has increased in daily price 5 times over.

Time to lock in profits? Personal trading preferences apply.

Now, I present to you GREK, the Global X MSCI Greece ETF.

Like a Corinthian Order, today’s move stood ten diameters high.

Can GREK get taller and more elegant?

Earlier today, Greece announced a “white smoke” agreement of bailout-mandated reforms.

With opposition from Greece’s “New Democracy” and some hesitancy from the EU, the deal is not complete.

However, for Greece, this step could change the country’s legacy.

Here are two charts on a weekly timeframe. The one on the right is IFN. Note the clean breakout over 26.00, the 2016 high and follow through.

The chart on the left is GREK. Today’s high 9.02 nearly matches the high from the week of May 27th, 2016 at 9.06.

With clear underlying support at 8.20-8.30, should GREK rise above 9.06, we can expect to see another $3.00 move up.

No guarantee of course. Yet, considering the freefall from its peak in 2014, should Greece stay in the EU’s favor, traders will pile in like Zeus did with Prometheus’ pile of ox bones.

Meanwhile, back in the U.S.A., discordance.

As the Russell 2000 (IWM) struggles below the monthly channel line and the 140 level, Granny Retail and Transportation gained.

Semiconductors, Regional Banks and Biotechnology followed the Russell’s lead.

Leave A Comment