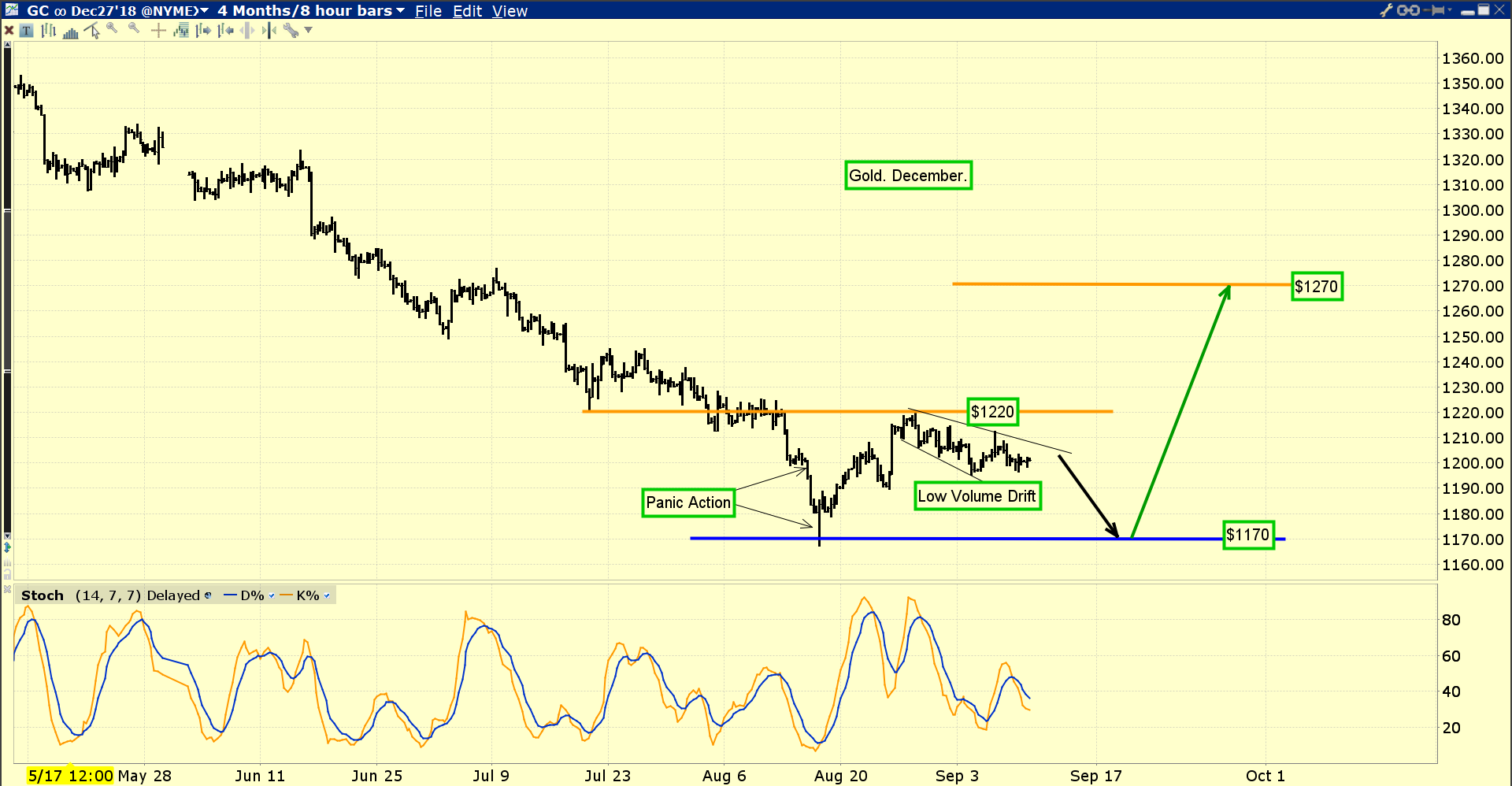

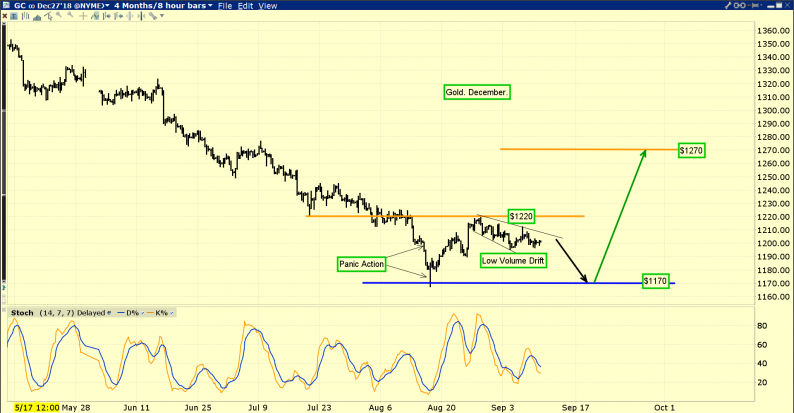

All gold market eyes should be on the late September time frame. The next rate hike decision from the Fed is September 26, and the next gold option expiry on the COMEX is September 25.

US trade announcements with Japan are also likely to happen around this same time frame.

The price action suggests a double bottom pattern is forming, and a second low near $1170 could occur around the same time that these important fundamental events occur.

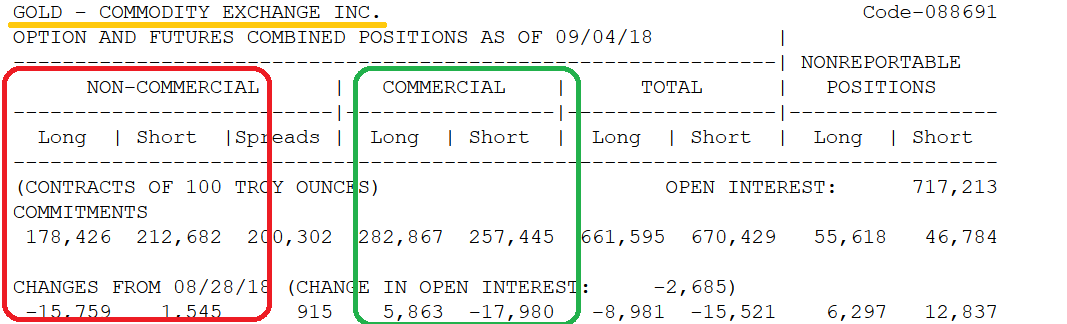

The latest COT reports shows the commercial traders eagerly buying more long positions and covering shorts.

Bullish investors need to be careful about reading too much into the COT reports. While most major gold price rallies do begin with the commercial traders being net long, they can quickly move back to the short side after limited upside price action.

Fundamental events like FOMC meets and COT reports tend to be catalysts for rallies, but it’s ultimately physical demand versus supply that determines the power of a gold price rally.

India’s central bank was last active in the gold market in a big way in 2009. Like the jewellers and citizens there, the central bank tends to buy price weakness. The latest purchase of almost seven tons in July is quite significant.

It will be interesting to see what the bank did in August, and in the months ahead. This may be the start of a new buy program for one of the world’s most important central banks.

Indian jewellers and citizens bought about one hundred tons of gold in August, and the commercial traders are likely buying longs on the COMEX in response to getting even more orders from Indian and Chinese dealers.

Rather than cut corporate, capital gains, and personal income taxes to zero, the US government has unfortunately decided to try to fix its horrible trade deficit with tariff taxes.

Ironically, these taxes may have increased the US trade deficit by pushing the yuan lower and crushing the rupee. The Chinese stock market has suffered a major pullback, and the dollar has surged higher against many currencies around the world.

Leave A Comment