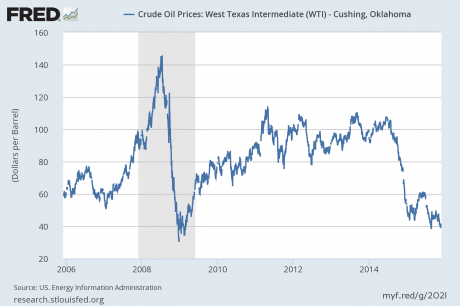

On Monday, the price of U.S. oil dropped below 38 dollars a barrel for the first time in six years. The last time the price of oil was this low, the global financial system was melting down and the U.S. economy was experiencing the worst recession that it had seen since the Great Depression of the 1930s.As I write this article, the price of U.S. oil is sitting at $37.65. For months, I have been warning that the crash in the price of oil would be extremely deflationary and would have severe consequences for the global economy. Nations such as Japan, Canada, Brazil and Russia have already plunged into recession, and of all major global stock market indexes are down at least 10 percent year to date.The first major global financial crisis since 2009 has begun, and things are only going to get worse as we head into 2016.

The global head of oil research at Societe Generale, Mike Wittner, says that his “head is spinning” after the stunning drop in the price of oil on Monday. Just like during the last financial crisis, we have broken the psychologically important 40 dollar barrier, and there are concerns that we could go much lower from here…

One analyst told CNBC that he believes that we could soon see the price of U.S. oil go all the way down to 32 dollars a barrel…

“We’re in a tug-of-war between a heavily shorted market and a glut of oil in the U.S. and globally, as Saudi Arabia continues to produce oil at elevated levels to maintain market share,” said Chris Jarvis at Caprock Risk Management, an energy markets consultancy in Frederick, Maryland.

“Couple this with a strengthening dollar as the market anticipates a U.S. rate hike this month, oil is heading lower with a near term target of $32 for WTI.”

Analysts at Goldman Sachs are even more pessimistic than that.According to Business Insider, they are saying that we could eventually see the price of oil go below 20 dollars a barrel…

Leave A Comment