Baker Hughes, a GE Company (BHGE), reported Q3 revenue of $5.38 billion and eps of $0.05. The company missed on revenue by $150 million, but delivered an earnings beat. Below is my takeaway on the quarter.

Revenue Growth Declined Slightly

In Q4 2016 the former Baker Hughes merged its operations with GE (GE) Oil & Gas. The transaction was completed in July. BHGE represents 37.5% of the merged entity. The deal gave GE greater exposure to the white hot North America land drilling segment, while it gave Baker Hughes added scale and diversification.

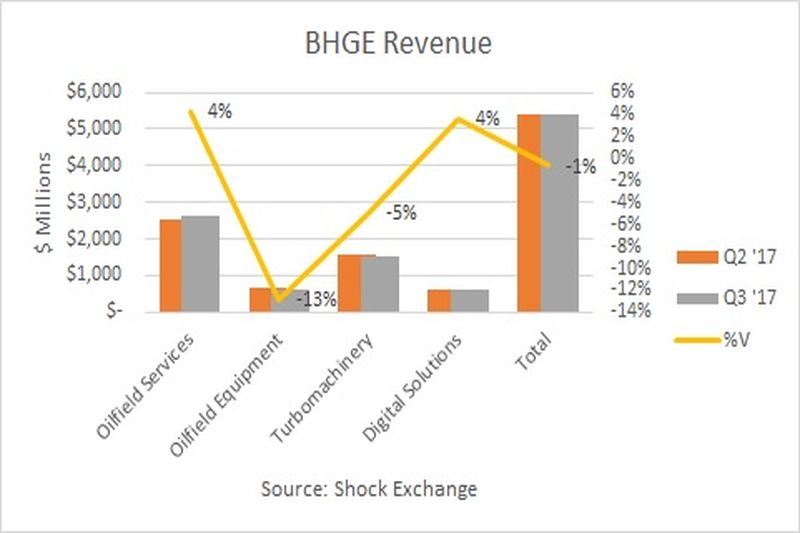

Out of the gates ,BHGE’s top line was nothing to write home about. Revenue growth was down 1% sequentially and flat Y/Y. The quarter was characterized by a push/pull between short cycle and long cycle businesses. Revenue from longer-cycle businesses such as Oilfield Equipment and Turbomachinery fell 13% and 5%, respectively. Revenue from shorter-cycle businesses such as Oilfield Services and Digital Solutions both rose 4%.

Oil prices above $50 drove higher completions in the oil patch. However, the 4% increase in Oilfield Services revenue lagged the 6% rise in the rig count during the quarter. Through October 13, the U.S. rig count was 913, up 65% Y/Y. However, it declined versus the previous week. As the rig count declines drillers will likely demand less oil services. This could connote declining growth for BHGE’s largest segment, which represents 49% of revenue.

Benefits Of Scale?

The merger was expected to add scale, particularly in Oilfield Services. I was concerned about the major exposure to subsea equipment and longer-cycle businesses Baker Hughes would get. That said, scale and cost synergies were expected to drive higher margins. BHGE’s EBITDA margin was around 9% during the quarter, much less than the 19% margins reported by rival Halliburton (HAL). BHGE has revenue diversification. Let’s see if it can improve margins amid potential headwinds in Oilfield Services, its bread and butter.

Leave A Comment