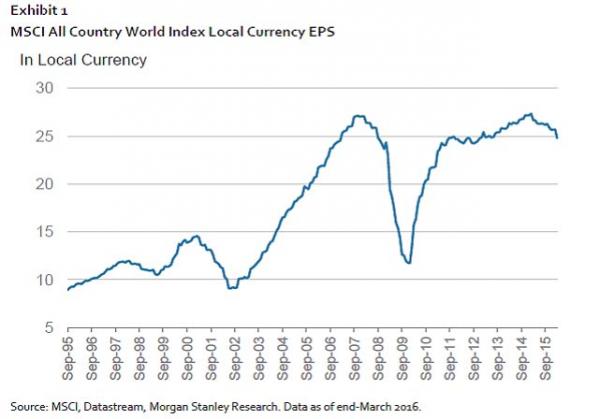

Has the Global Earnings Recession Finished?

We think it’s too soon to declare that the global earnings recession has finished and remain neutral equities in our asset allocation framework.

The MSCI ACWI index has risen by 12.7% since the recent trough on February 11 and is now essentially flat year to date. However, it remains some 10% below the peak which was as long ago as the end of last May. The primary determinant of whether the bull market in equities resumes or the rally fades will likely be earnings rather than the multiple. The ACWI trailing P/E is currently around 21x, almost exactly in line with the long-run average since 1988.

The earnings recession in equities began in EM (in local currency terms) in late 2013 and in DM in February 2015. Since then earnings have declined by 14.6% for EM and by 9.5% for DM.

Globally we calculate that earnings are currently falling in 29 of the largest 30 MSCI ACWI markets, with the sole exception being Switzerland. For DM this is the seventh earnings recession since the early 1970s. If it ends now it will tie for the least severe in percentage decline terms and win for being the shortest in months of duration of the last 45 years. The longest earnings recession was that which ran from August 1989 to June 1993 while the deepest was the 60% decline in earnings during the GFC.

Morgan Stanley pegs the risk of global economic recession at 30% currently. Five of the prior six earnings recessions were associated with economic recessions in DM, but one was not. That was the earnings recession triggered by the Asian Financial Crisis. It lasted from April 1998 to June 1999, with earnings falling by 10% peak to trough, approximately the same decline as has occured in DM so far.

In EM the current earnings recession, although not the deepest — the Asian crisis holds the record with a 56% peak to trough decline — is already the longest by far. The earliest markets to go into earnings recession were Brazil and Russia, with China and Taiwan the latest.

Leave A Comment