The media is atwitter (no pun intended) about Bitcoin (BITCOMP, GBTC) which is up like a rocket, and just became available in futures contracts. I am not onboard with this asset at this time, but with all the publicity and a smattering of inquiries from clients, I need to provide some background information.

First a regret (I suppose) to one client who a few years ago suggested a little taste of Bitcoin; but I told him I did not see it as real — didn’t know how to safely get involved — and passed on it. Well, $1,000 in Bitcoin at that time, which would have been a round-off number for him, would be worth around $1.7 million today (unless, of course, the platform we used was one of those early platforms that failed, where all investor funds simply went “poof”).

In hindsight, I wish I had made that tiny investment for him and for me — the “poof” would not have hurt either of us — although I probably would have lost my client for reckless behavior.

I know I made a reasonable decision at the time, based on what was known then. I did the right thing as a fiduciary — I just feel envious now of those with a love of casinos who took a shot. I could always use an extra $1.7 million.

A friend of mine bought some Bitcoin, because her son bought some. So far she is very happy to have done so. I bought some Canadian marijuana penny stocks, because my son bought some. So far I am very happy to have done so as well — just not nearly as happy as she is.

Your children may talk to you about Bitcoin; or you may find Bitcoin to be a topic of discussion among enthusiasts at a cocktail party. This article may help you hold up your end of the conversation.

PRICE WATERHOUSE COOPERS REPORT

In August 2015, PwC published are report on cryptocurrency titled: “Money is no object: Understanding the evolving cryptocurrency market “. It said,

“Cryptocurrency: media sensation and investment fad? The issue is no longer whether cryptocurrency will survive, but rather how it will evolve. Each of the five key market participants— merchants and consumers, tech developers, investors, financial institutions, and regulators—will play a critical role in this process.

… It has been called one of the “greatest technological breakthroughs since the Internet.” It also has been called “a black hole” into which a consumer’s money could just disappear. The subject at hand is cryptocurrency—a medium of exchange created and stored electronically, and using encryption techniques to control the creation of monetary units and to verify the transfer of funds”

BUBBLE and BUBBLE SYTEMATIC RISK

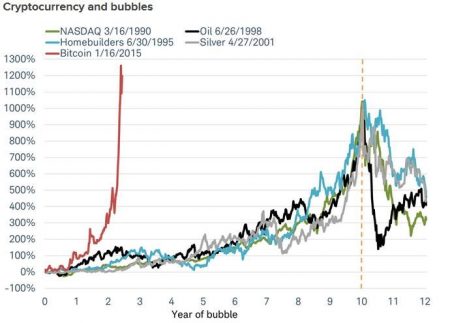

Schwab posted an article about the price behavior or bubbles and their risk to the financial system. They suggested that asset categories that rise 10 fold over 10 years without fundamental underpinnings tend to be in bubbles that pose systematic risk.

The importance of 10 years is to have given the asset time to be widely held and embedded in portfolios across the breath of investors.

In the chart below, they show the price pattern in the 10-years prior to the bubble peak for the NASDAQ (dotcom era), Homebuilders, Oil and Silver bubbles. When those broke they had systematic impact.

The chart also shows the short-term meteoric rise of Bitcoin, which any technical analysis would say is in a massive bubble — however, the bubble has inflated so fast that it has not become widely held or embedded in a broad spectrum of portfolios. The implication is that if it crashes, it will not have systematic impact. That means we will not become concerned about our stock and bond positions if Bitcoin speculators get wiped out.

(click images to enlarge)

NYSE BITCOIN INDEX and BITCOIN ETF

The following chart of the NYSE Bitcoin index (in black), and the only Bitcoin ETF (GBTC, in gold), and the daily price changes as a percent (in red), shows that the ETF had some devastating drawdowns that would have flushed out most people who had anything more than lunch money at risk.

It also shows that nearly 60% of the gain occurred in the last month.

Projectiles fired straight up into the air almost always come back down just as straight. That could happen here. Maybe not, but my stomach isn’t fit for that much excitement, and none of my clients are either when it comes to their retirement portfolio.

Clients are welcome to experiment with the ETF on their own, but not through me as a fiduciary.

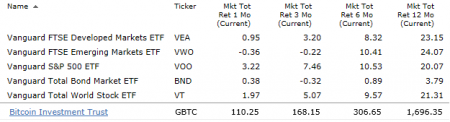

Here are a few data points about the ETF:

This table shows the 1-mo, 3-mo, 6-mo and 12-mo returns of the Bitcoin ETF versus the ETFs for Total World stocks, S&P 500 stocks, non-US Developed market stocks, Emerging market stocks and US Aggregate bonds. No contest, of course, but I thought you might like to know.

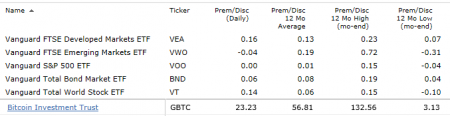

Here is the discount or premium above the underlying asset value for the Bitcoin ETF and the other ETFs in the list.

You can see that while the premium for GBTC is high at over 20%; it is way down from the 130% 1-year high premium, and the 56% 12-month average premium.

That is a small good sign, in an otherwise boiling hot bubble. Or maybe it shows the bubble is losing some followers.

Here are the expenses of the funds.

At 2%, the management fee of GBTC is very high as far as ETFs go: but are not of any consequence under bubble conditions. The total expenses are not yet known, but they couldn’t compare to the price appreciation.

OVER THE COUNTER BITCON FUND

GBTC is the ticker symbol for The Bitcoin Investment Trust, a trust run by Grayscale that holds Bitcoins. You can buy it at your broker, but it is not “listed”.

Leave A Comment