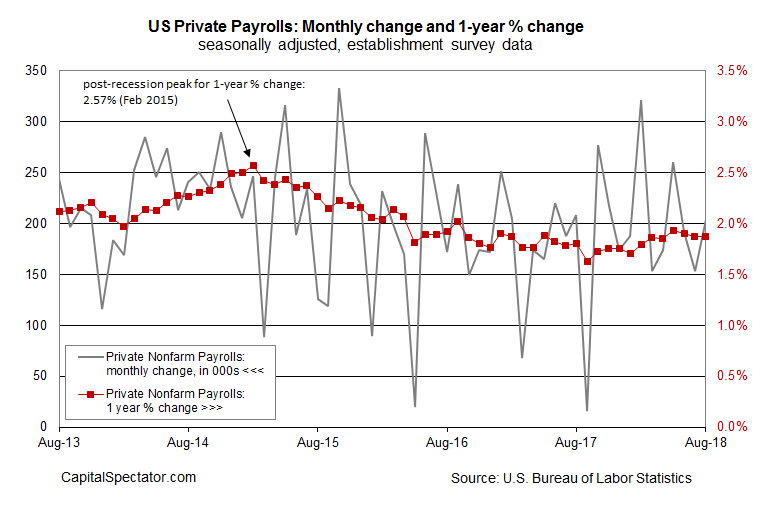

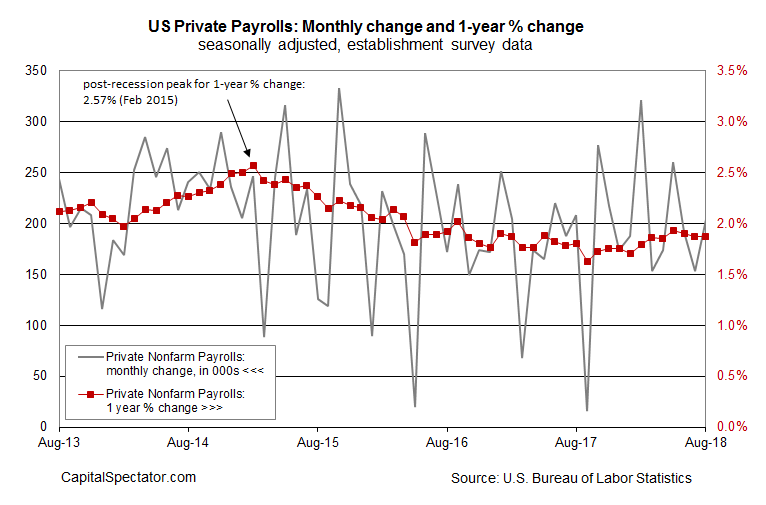

Private payrolls in the US increased by a seasonally adjusted 204,000 in August, marking a sharply stronger gain over the previous month’s revised 153,000 advance, the Labor Department reports. Meantime, the year-over-over trend held steady at a 1.9% pace for the sixth month in a row. Today’s numbers reaffirm that the labor market continues to expand at a healthy rate, a sign that the nine-year-old economic expansion is in no immediate danger and so further monetary policy tightening has a green light to continue.

Measuring the trend in payrolls via one-year changes shows that the recent revival in the growth rate is stable. A year ago, the trend in private-sector employment was decelerating, dropping to a gain as low as 1.6% for the 12 months through September 2017. Since then, companies have been hiring more workers. Since March, the annual pace has more or less held steady at around 1.9%.

Today’s upbeat news on payrolls and the economy provides fresh support for the Federal Reserve to raise interest rates again. “Gradually increasing over the course of this next year makes sense,” Boston Fed President Eric Rosengren told CNBC earlier today. “If things work out well for the economy, and that’s what I expect and hope, then we’ll be in a situation where we need to have somewhat restrictive policy over time.”

Fed funds futures are pricing in a near-certainty that the central bank will announce another rate hike at the next FOMC announcement on September 26. CME data this morning points to a 99% probability that the target Fed funds rate will edge up 25 basis points to a 2.0%-to-2.25% range.

Today’s update also shows that wage growth is ticking higher. Average hourly earnings increased 2.9% — the fastest rate in nine years. The firmer pace offers lays the groundwork for questioning the Treasury market’s forecast that inflation’s recent rebound has peaked.

Leave A Comment