The UK government tried very hard to hold on. They had been able to raise $200 million from JP Morgan, a significant sum at that time under those circumstances. The British had also secured an almost equal amount from banks in France. The new National Government had produced a budget slashing spending by £70 million, while also raising taxes by £75 million. None of it was enough, the die long past cast.

The pound was under intense pressure in 1931, a result of the deepening depression. The Bank of England lost £56 million of its gold reserves in July ’31 alone defending sterling convertibility. By mid-September officials believed themselves out of options. On Saturday, September 19, the British government acted. Bank of England Governor Montagu Norman, on a steamer returning from the US, didn’t even know it had happened until he got back to Liverpool the following Wednesday.

Until His Majesty by Proclamation otherwise directs subsection 2 of section one of the Gold Standard Act of 1925 shall cease to have effect.

There were widespread effects as with most changes of this magnitude, including interest rates in the United States that jumped amidst deflation and depression. On October 16, 1931, the Federal Reserve voted to raise the Discount Rate by 200 bps, from 1.5% to 3.5%. American banks already crushed by illiquidity in the previous waves of bank runs liquidated US government paper to hold cash.

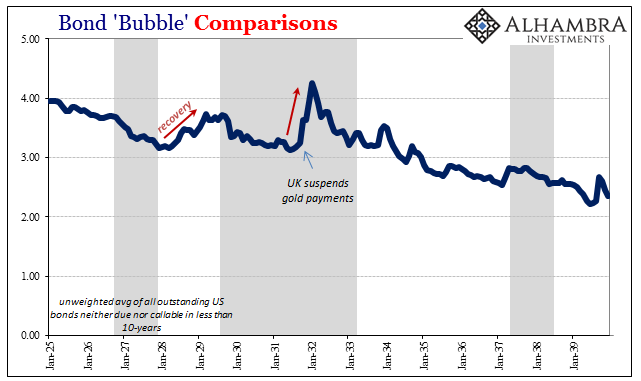

The long-term US Treasury bond rate that had fallen to around 3.15% in the middle of 1931, was suddenly headed back toward 4% and higher. The BOND ROUT!!! would last about five months, with the long-term yield peaking around 4.25% in January 1932.

It would be the last of the great bond selloffs for some time. Treasury yields, even money rates, would remain low throughout the Great Depression. In times of stress and uncertainty, monetary as well as economic, liquidity preferences rule.

The bond market of the last fifteen years or so is on much the same trajectory, the behavior of the UST curve eerily similar. There is far more volatility to yields now compared to eight decades ago, a product of trading and financialization over that wide intervening period.

Leave A Comment