Household debt is a predictor of economic downturns according to a recent study by Atif R. Mian, Amir Sufi and Emil Verner. They looked at 30 countries over 1960 – 2012 and found that rising debt was an ominous sign for economic growth.

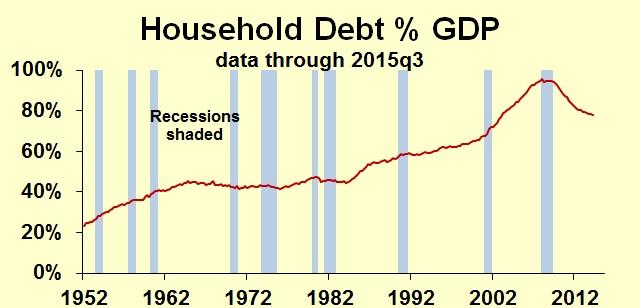

Should I be looking at debt when I make my forecasts? The chart below shows U.S. household debt as a percentage of gross domestic product, the measure that the authors of the study used. By eyeball I certainly don’t see increasing debt as an indicator of recession or slowdown. There have been several periods of upward trend: the 1950s, mid-1980s, early 2000s. Only in the latest period was rising debt followed by a recession. But if you had used this indicator by itself, you would have called for a recession in 2003, long before the economy tanked.

Back around 1988 I served on the American Bankers Association’s Economic Advisory Council. One of our members had a sour economic forecast because of rising consumer debt burdens. You can see on the chart the rise in debt from 1984 through 1986. There was no recession until 1991—and that recession was mild.

Household debt may be a useful indicator in other countries—this report studied 30 nations in all. It may also be useful in a more complete model of the economy. That is, study a large number of important factors and household debt may turn out to be one of them.

Finally, note the most recent data: household debt has been falling relative to GDP: no warning sign yet.

Data: To look at U.S. data, hit the Fred database. The original source data on household debt is the Federal Reserve and on GDP the Bureau of Economic Analysis.

Leave A Comment