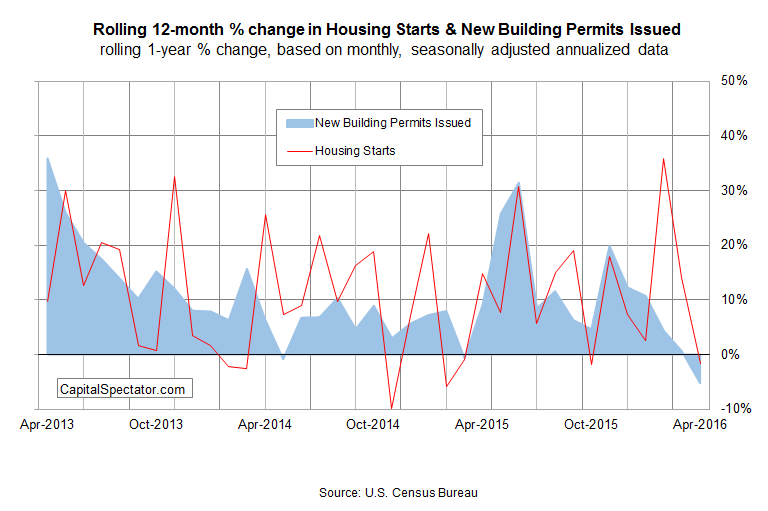

US housing starts and industrial activity posted solid increases in April, rising by stronger-than-expected rates last month. But the upbeat news is clouded by negative trends for the year-over-year data. In the housing sector, the change in tone on the downside is conspicuous—for the first time in 13 months, new residential construction and newly issued building permits fell relative to their respective year-earlier levels. Meanwhile, industrial output rebounded sharply in April, rising by a better-than-projected 0.7%. But the improvement wasn’t enough to reverse the red ink in the annual comparison. As a result, US industrial activity contracted last month in year-over-year terms–as it’s been doing since last September.

The monthly figures suggest that better days are coming. But short-term data is noisy and generally unreliable for monitoring business-cycle risk. As such, overcoming the dark clouds that hang over the year-over-year numbers will require strong and consistent monthly gains for the near term. For the moment, however, gravity prevails, as the following charts show.

As noted, housing construction and new permits are now falling—at the same time—vs. year-earlier levels. Could it be noise? Perhaps, but the jig may be up if the red ink doesn’t fade in next month’s report.

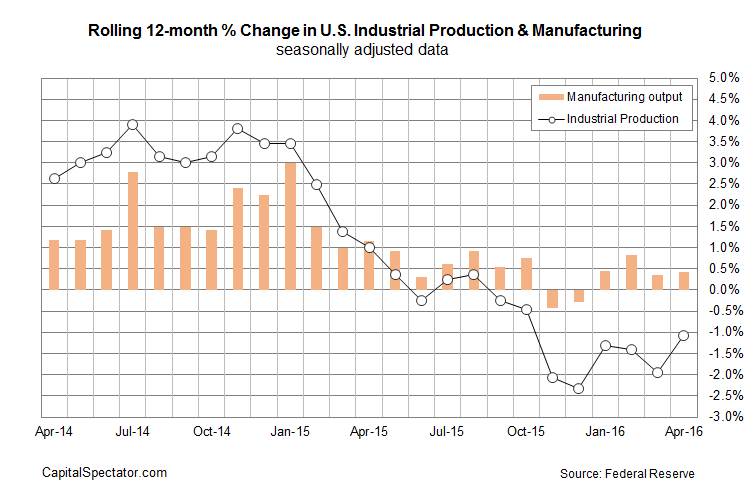

Industrial output is still sinking in annual terms, although the manufacturing component is holding on to small gains in the year-over-year column. Note, too, that the annual slide in headline industrial activity revived in relative terms to the smallest decrease—down 1.1%–in six months. If you’re so inclined, that comparatively soft decrease offers a hint for thinking that repair and recovery are now in progress on this front.

For the broad economy, the main source of optimism—and arguing that today’s releases are a sideshow—is the US labor market. But growth in payrolls slowed in April, dealing a setback to the bullish view that the proverbial glass is still half full.

Leave A Comment