“Davidson” submits:

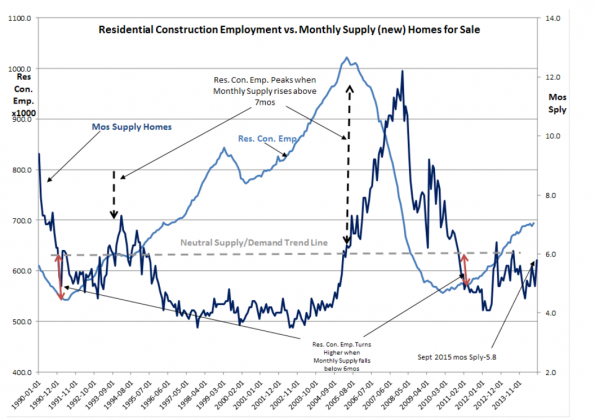

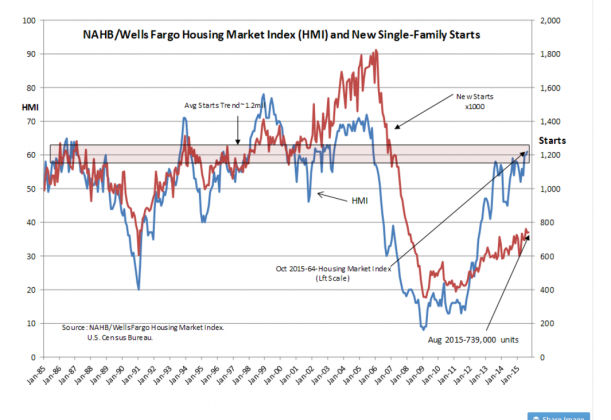

Reported this morning were New Home sales with Monthly Supply of New Homes for Sale at 5.8mo. Couple this to last week’s NAHB HMI (Housing Market Index) and one can see that the housing sector continues to expand. For investors, what is important is not the overall housing sector, but Single-Family Home Sales, Starts and the Monthly Supply which is the relationship of inventory of Single-Family Homes for Sale divided by the most recent month’s sales figure. ($XHB)

The pace of Single-Family Home Sales activity as reflected in the HMI and Monthly Supply is really a reflection of the general employment trend and the financial health of individuals in the economy. Buying a new Single-Family Home is dependent on current regulations, credit spreads, the financial health of lending institutions, the financial health of individual borrowers and expectations for the future(“The Recency Effect”). When these trends are rising, the impact to economic expansion is significant. The impact of a rising Single-Family Housing market is far more important than the Multi-Family Housing market as the former relates more directly to individual financial health and the perception of the future than the latter which relies on corporate financials.

The financial well-being of individuals and the perception by financial firms that individuals represent a good credit risk is what makes equity markets rise over time. The improvement in the perception of individual financials as an economic cycle proceeds is called “The Recency Effect”. This cycle while slower than past cycles with the slew of regulations added since 2009 continues to improve. How fast the future improvement in individual lending occurs is difficult to predict. History shows we tend to ease underwriting standards set during the most recent recession till the economy has run out of room to support it. My guess today is that we still have another 5yrs or so till the current economic expansion peaks, but peak lending may prove to be further out if the current slow pace does not accelerate. Single-Family Housing is one of the sectors which provides vital warning signals of an economic peak. There are no signs of a peak currently.

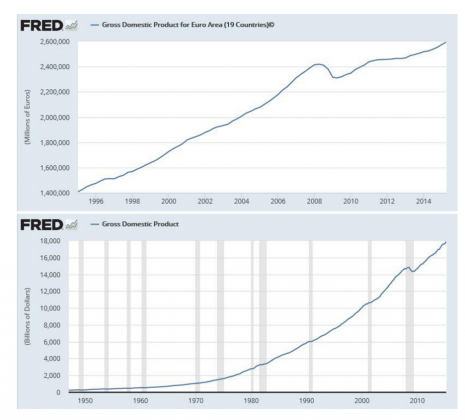

Thus far, all hard-count* economic measures continue to reflect continued economic expansion. As long as economic expansion continues, stock markets have risen with improving market psychology. My advice to investors remains that it is best to be globally diversified. Even though Intl LgCap and NatResource asset classes have underperformed the past several years due to Hedge Fund manipulations, the recommended managers continue to out-perform their benchmarks. There continues to be a global economic expansion as shown by the data for the GDP for Euro Area and the US Gross Domestic Product-see the charts. Equities historically ‘catch-up’ to fundamentals over time. *(By ‘hard-count’ I mean actual counts of things produced economically, i.e. how many cars, how many homes, how many people employed. ‘Soft-count’ measures are the PMI measures and University of Michigan Survey which measure society’s sentiment. Only ‘hard-count’ economic data are useful forecasting information.)

Leave A Comment