For most retirees age 65 and over, the spending power which they rely on from government retirement programs is their Social Security benefits after their Medicare Part B premiums have been withheld.

Because Social Security is in theory supposed to be fully inflation-indexed, many people believe their standards of living in retirement will be fully protected from inflation. However, when we look at what matters the most, which is the purchasing power of Social Security net of Medicare premiums – that particular number has never been intended to keep up with the rate of inflation, as a matter of design.

Current retirees have received a rude wake-up call in recent years, with the increases in their Medicare Part B premiums consuming almost all of their very small increases in Social Security benefits. This is a process that is, however, still in its early stages. Particularly if higher rates of inflation are indeed returning, then the impact on retiree standards of living may be swift, powerful and sustained.

Crucially, this is a repetitive and cumulative process. This creates an unfortunate knowledge mismatch between the generations. Those who are currently retired are generally well aware – but they do not face the worst of the financial damage. It is those who are not yet of retirement age that face the greatest risk to their financial plans – but they are also the least likely to be aware of these issues.

The goal of this sixth analysis in a series is to give you an early and comprehensive understanding of what is likely to become a defining challenge for an entire nation when it comes to both personal and national standards of living in retirement. An overview of the first five analyses and other related analyses is linked here.

Social Security Net Of Medicare Is Not Fully Inflation-Indexed

In the previous Part 5 analysis, we conceptually explored eight factors that will be driving Medicare premiums up at a higher growth rate than the future increases in Social Security benefits. Projecting a substantially higher growth rate in Medicare premiums is not the slightest bit controversial, but rather it is almost universally expected by the experts who study these issues. It is also built right in to the federal government’s own long-term financial projections.

The mathematics of the increasing premiums are quite clear – multiple factors will merge together to reduce standards of living in retirement to a degree that will grow steadily stronger over time. This will impact everyone who is enrolled in both Social Security and Medicare – there is no opting out.

Yet, very few people are aware of this or are properly taking it into account.

To make this vitally important information more accessible and understandable, we will separate out three different issues, and isolate the real world impact for an average retiree. This analysis will focus on one simple but a life-changing question – what happens to the inflation protection for net benefits in an individual year when Medicare premiums increase at a different rate than Social Security benefits?

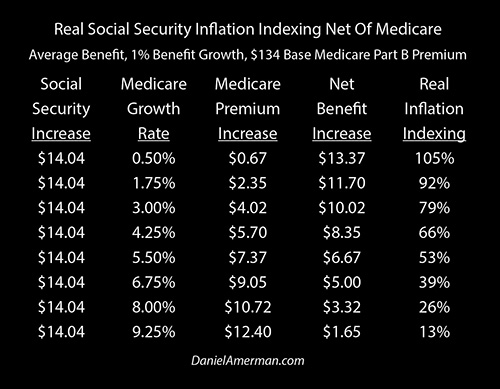

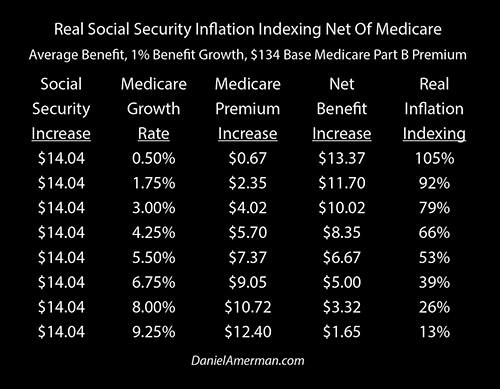

We can see an example of how this works at various levels of percentage increases in Medicare premiums in the table above.

As our starting point, we’re assuming a monthly gross Social Security payment of $1,404 dollars which is the national average for 2018. The base Medicare Part B premium in 2018 is $134. So if we take a $1,404 benefit and withhold a $134 Medicare Part B premium, this means that for the average retiree their net payments for 2018 – what they can actually spend – are about $1,270 per month, or a little over $15,000 per year.

Over the last three years in practice, we have seen Social Security benefits climbing at a rate (again, this is covered in the previous analyses) of about 0.75% per year. For this first example, we’ll increase that a little bit, and assume benefits go up by 1.0%. A 1.0% benefit increase on a starting benefit of $1,404 works out to be $14.04 dollars a month, as can be seen in the “Social Security Increase” column on the far left.

The next question is how much Medicare premiums increase in any given year, and the “Medicare Growth Rate” column has a number of possibilities. In practice, base Medicare Part B premiums have gone up by an average of about 8.5% per year over the last three years. For this first example, we’ll bring that down a bit and assume an 8% increase.

If we multiply our base $134 Medicare Part B premium times 8%, that means that our Medicare premium is going up by $10.72 cents per month, as can be seen in the “Medicare Premium Increase” column.

So if the gross Social Security benefit increase goes up by $14.04, and the Medicare premium goes up by $10.72, that means that the average retiree would receive a net benefit increase by only $3.32, as seen in the “Net Benefit Increase” column, This means that their new net benefit is about $1,273.

Leave A Comment