Readers will remember that we chose Freeport-McMoRan as our top pick a couple of weeks ago, right before its share price exploded. Meantime, the stock has doubled in price, in a matter of weeks. Is it time to take profits? How much more upside is there?

First, the daily chart shows that resistance is near. Based on the trendline, we see resistance right below $14. That is confirmed by a resistance area (see purple rectangle), which coincides with previous support, between $14 and $16. Given today’s closing price at $10.99, we would say there is some 25% of upside potential on the short term.

On the longer term chart, the weekly, we come to the same conclusion. In other words, the weekly chart does not reveal any additional insight. Watch how the 90 WMA is declining at a very fast pace currently, so it is a matter of weeks until it gets to the $16 area, which, once again, confirms the validity of that resistance area.

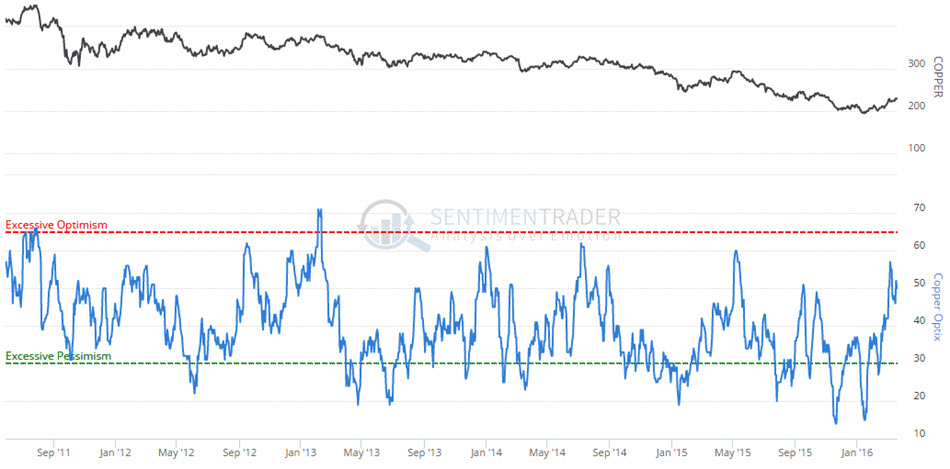

The copper price, definitely an important indicator / driver for FCX, still has a little bit of upside potential, but it is rather limited. First resistance is just 5 pct above today’s closing prices, and, best case, copper can rally till the $2.6 mark.

Last but not least, sentiment in the copper market is moving towards the excessive area. That confirms the limited upside potential in the short run. It would take a lot to push both sentiment to excessive readings as well as price through resistance, we simply don’t expect this to happen in the short to mid term.

CONCLUSION:

Our readers were very beneficial to receive FCX as our top pick when it was trading 50% below today’s prices. However, the upside potential is limited, so we believe it’s about time to take some profits off the table, with a target around 10% above today’s closing price. Long term investors can get their initially invested capital back and keep the remaining shares for free.

Leave A Comment