This is one of those stories that gets more amazing the further you dig into it. Seems that while Chicago descends into a very public, front page news bankruptcy, Kentucky is, dollar for dollar, screwing up even more badly:

“(From Kentucky.com) – The $16 billion Kentucky Retirement Systems on Thursday lowered the rate of investment return it assumes state pension assets will earn, which means funding levels for two tax-subsidized systems — ranked among the nation’s worst — fell even further.

For the next state budget, the change means lawmakers must find tens of millions of extra dollars to keep the retirement systems afloat. The state’s annual recommended contribution to KRS already was expected to hit $880 million.

“We’re in a disastrous cash position. We need help immediately from the next governor and the legislature,” said Jim Carroll, a member of an advocacy group called Kentucky Government Retirees. “We’re in a fund that can’t afford any more market losses. There’s no cushion left. What happens if the market crashes is, we go flat busted, and then maybe a judge has to step in and order the state to make payments.”

The KRS board of trustees voted to drop the assumed rate of return from 7.5 percent to 6.75 percent for two of the pension funds the agency oversees, the Kentucky Employees Retirement System (Non-Hazardous), which includes 120,595 state workers and retirees, and the State Police Retirement System, which includes 2,379 active and retired troopers.

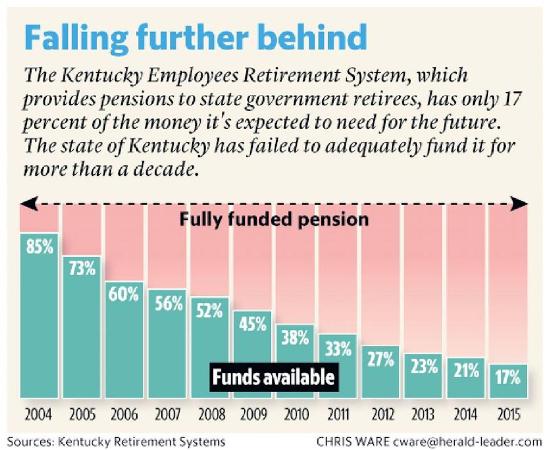

Consequently, KERS now has only 17 percent of the money it’s expected to need to pay promised benefits, down from the 19 percent announced just last month, and it faces $10.9 billion in unfunded liabilities, as compared to the previous sum of $10 billion. SPRS’ funding level now stands at 31 percent, down from last month’s 33 percent, and it must cover a $542 million gap in coming years, up from $485 million.

Leave A Comment