American equities have been a good place to invest during the current bull market, now in its eighth year. Since the November election, the S&P 500 Index has surged close to 16 percent. But this means that valuations continue to creep up, and political risk threatens to derail further gains as President Donald Trump’s high-growth agenda stumble on even more roadblocks.

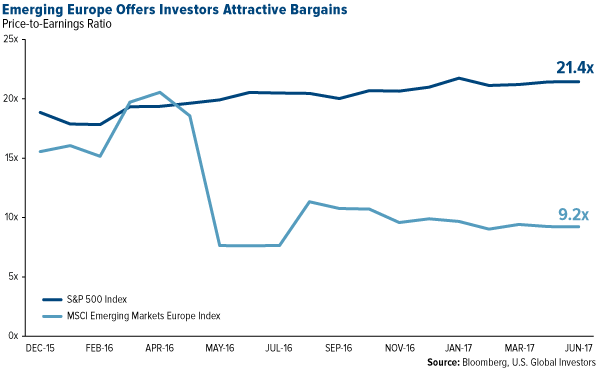

Investors might, therefore, be looking for an alternative. I believe one of the most attractive destinations for your investment dollars right now is emerging European countries. Below you can see a valuation comparison between U.S. and emerging European equities. Trading at 9.2 times earnings, the latter are offering quite a bargain for investors seeking a “better bang for the buck.”

More than that, though, “core” Central and Eastern Europe (CEE) countries—including Poland, the Czech Republic, Romania and Hungary—are currently among the fastest growing in the world. In a recent series on the region, the Financial Times put it succinctly: “The former communist countries that have joined the European Union (EU) since 2004 offer superior growth to western Europe and many other emerging markets, combined with the benefits and protections of EU membership.”

Expectations for economic growth in CEE countries have changed rapidly and positively. The consensus forecast is now 2.5 percent growth this year, 0.3 percent points higher than expectations near the beginning of the year.

Next year could be even brighter, with analysts expecting 2.6 percent growth, 0.1 percentage point higher than earlier forecasts. Stronger-than-expected external demand in Western Europe, a tighter labor market, an attractive environment for foreign investment, government stimulus measures, easy financing conditions and the revival of EU structural funds are all supporting stronger growth in the region.

Manufacturing Continues to Strengthen

Loyal readers of Frank Talk know that we closely follow the purchasing manager’s index (PMI), which measures the strength of a country’s manufacturing industry. We’ve found it to be not only a handy gauge of future commodities demand but also a country’s or region’s economic growth potential.

Leave A Comment