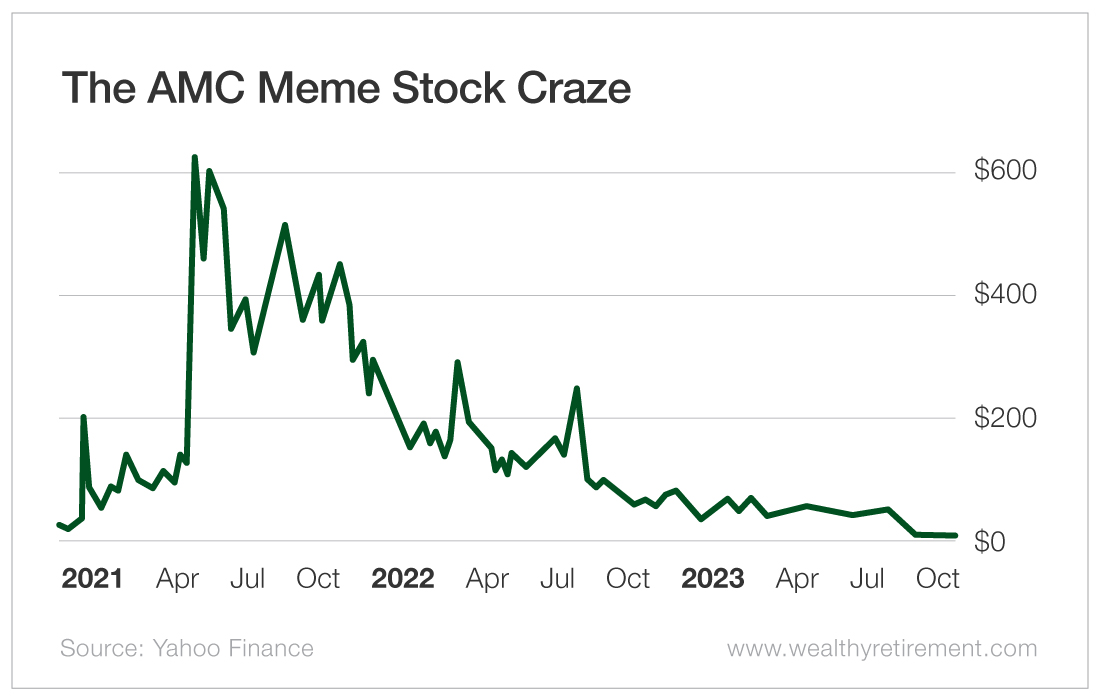

Image Source: PexelsHave you ever taken a class where it felt like the professor opened up your brain like an empty Tupperware container and filled it with knowledge?That’s what happened to me when I took a graduate-level class with one of my mentors in technical analysis, Dr. Hank Pruden.For those of you who are unfamiliar with the term “technical analysis,” it refers to analyzing a market or an individual asset using charts.I was expecting to learn about trend lines, bullish and bearish patterns, cycle analysis, etc., in this class. Instead, we dove deep into the psychology of the markets, trying to understand what motivates investors and traders to act the way they do.Today, there are many institutions that teach behavioral finance, but at the time, it was groundbreaking stuff.One of the most important concepts is that investors’ behaviors repeat time and time again. There are no guarantees, of course, and every situation will be a little different, but humans can be fairly predictable.We typically fear the worst just before things get better… and we expect things will always be this good just before they get worse.This course taught me a number of key ideas that I still use nearly three decades later. Here are a few of the most impactful ones.Confirmation BiasConfirmation bias occurs when you focus only on the information that confirms your beliefs. People do this with their political beliefs all the time, and the media plays into it by exclusively giving them information that aligns with their point of view.In the markets, an investor may believe that a stock is a great buy because they see the company’s products everywhere… which may cause them to ignore the fact that the stock has been in a downtrend all year. Despite the market signaling that things are not great for the company, the investor buys the stock anyway.OverconfidenceI’d bet almost everyone reading this believes they’re a better-than-average driver. In college, I had an argument with a friend about what a horrible driver he was. “How many cars have you totaled?” I asked. (The number was three in the previous four years.) “Yeah, but they were all somebody else’s fault!” he exclaimed.Enough said.When things are going well in the markets, investors often confuse a bull market with their own genius and think they’ll know when to get out. Of course, it doesn’t work out that way.The Herd EffectHow many times have you been looking for a place to eat and walked past an empty restaurant to wait at a crowded one?We’ve seen this time and again in investing, like when people piled into dot-com stocks, crypto, cannabis stocks, and meme stocks because that’s what everyone else was doing.Being aware of these concepts can help you question your own decision-making and ensure that you’re thinking critically about each buy and sell.You can also use stock charts to test your opinion.For example, in early 2021, AMC Entertainment Holdings (AMC), the poster child for meme stocks, took off. The stock moved from the $20s (split-adjusted) to over $600 in a few months.

Image Source: PexelsHave you ever taken a class where it felt like the professor opened up your brain like an empty Tupperware container and filled it with knowledge?That’s what happened to me when I took a graduate-level class with one of my mentors in technical analysis, Dr. Hank Pruden.For those of you who are unfamiliar with the term “technical analysis,” it refers to analyzing a market or an individual asset using charts.I was expecting to learn about trend lines, bullish and bearish patterns, cycle analysis, etc., in this class. Instead, we dove deep into the psychology of the markets, trying to understand what motivates investors and traders to act the way they do.Today, there are many institutions that teach behavioral finance, but at the time, it was groundbreaking stuff.One of the most important concepts is that investors’ behaviors repeat time and time again. There are no guarantees, of course, and every situation will be a little different, but humans can be fairly predictable.We typically fear the worst just before things get better… and we expect things will always be this good just before they get worse.This course taught me a number of key ideas that I still use nearly three decades later. Here are a few of the most impactful ones.Confirmation BiasConfirmation bias occurs when you focus only on the information that confirms your beliefs. People do this with their political beliefs all the time, and the media plays into it by exclusively giving them information that aligns with their point of view.In the markets, an investor may believe that a stock is a great buy because they see the company’s products everywhere… which may cause them to ignore the fact that the stock has been in a downtrend all year. Despite the market signaling that things are not great for the company, the investor buys the stock anyway.OverconfidenceI’d bet almost everyone reading this believes they’re a better-than-average driver. In college, I had an argument with a friend about what a horrible driver he was. “How many cars have you totaled?” I asked. (The number was three in the previous four years.) “Yeah, but they were all somebody else’s fault!” he exclaimed.Enough said.When things are going well in the markets, investors often confuse a bull market with their own genius and think they’ll know when to get out. Of course, it doesn’t work out that way.The Herd EffectHow many times have you been looking for a place to eat and walked past an empty restaurant to wait at a crowded one?We’ve seen this time and again in investing, like when people piled into dot-com stocks, crypto, cannabis stocks, and meme stocks because that’s what everyone else was doing.Being aware of these concepts can help you question your own decision-making and ensure that you’re thinking critically about each buy and sell.You can also use stock charts to test your opinion.For example, in early 2021, AMC Entertainment Holdings (AMC), the poster child for meme stocks, took off. The stock moved from the $20s (split-adjusted) to over $600 in a few months. And keep in mind, this was not some new tech company or a biotech that had a cure for cancer. AMC is a movie theater chain. And you’ll recall that in 2021, no one was going to the movies. So it made no sense that everyone was piling into the stock.Let’s say you were on Reddit or some other message board reading about AMC and all the reasons it should go higher. One look at the parabolic move on the chart would tell you to be very careful… because when the stock stopped going higher, it was likely going to reverse quickly.Technical analysis is simply the visual representation of investors’ emotions. The more aware you are of those emotions and behaviors and how to interpret them, the better a trader and investor you’re going to be.More By This Author:Is There Still Hope For Walgreens’ 9% Dividend Yield? Here’s Why Everyone Should Be Excited For Earnings SeasonWill SunCoke Energy’s Earnings Save Its 4% Yield?

And keep in mind, this was not some new tech company or a biotech that had a cure for cancer. AMC is a movie theater chain. And you’ll recall that in 2021, no one was going to the movies. So it made no sense that everyone was piling into the stock.Let’s say you were on Reddit or some other message board reading about AMC and all the reasons it should go higher. One look at the parabolic move on the chart would tell you to be very careful… because when the stock stopped going higher, it was likely going to reverse quickly.Technical analysis is simply the visual representation of investors’ emotions. The more aware you are of those emotions and behaviors and how to interpret them, the better a trader and investor you’re going to be.More By This Author:Is There Still Hope For Walgreens’ 9% Dividend Yield? Here’s Why Everyone Should Be Excited For Earnings SeasonWill SunCoke Energy’s Earnings Save Its 4% Yield?

Leave A Comment