Idiosyncratic risk, volatility not explained by the larger beta market environment, is on the rise. Median 63-day rolling risk has not just hit new highs since the financial crisis, the Morgan Stanley report dated December 12 noted. But the idiosyncratic risk has risen to highs not seen since October 2000.

Idiosyncratic risk up significantly as overall market volatility hits all-time lows, Morgan Stanley Report observes

Stock specific risk is “up sharply” on a 63-day as well as 252-day basis, Brian Hayes and his quantitative equity research team at Morgan Stanley observed, noting that such risk is “positive for subsequent alpha generation.”

The rise in individual stock risk comes as the overall stock market is experiencing historically low volatility, illustrating how noncorrelated volatility factors can mitigate each other. The CBOE VIX index was trading at 9.28 today, almost half its longer term average.

In small cap stocks, valuation factors, after having difficulty throughout 2017, have been staging a rebound, a Bank of America Merrill Lynch report recently noted. When looking at the entire stock market, including large capitalization stocks, the picture is slightly different.

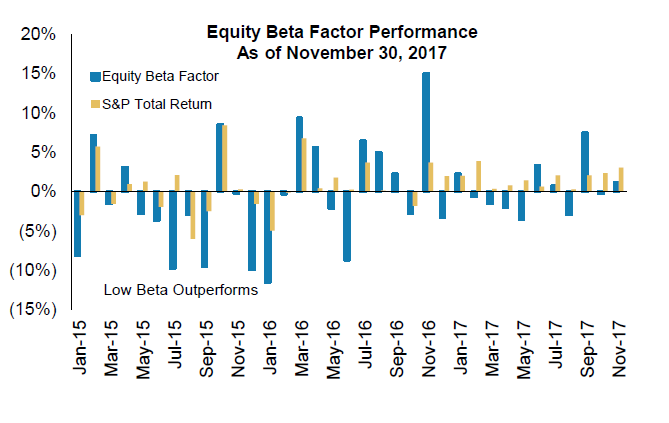

While the performance of equity factors can differ from study to study to study based on how they are defined, the Morgan Stanley report noted that “neither growth nor value stocks outperformed in November,” which was juxtaposed to the BAML findings for small-cap stocks.

Idiosyncratic risk in reverse: growth stocks performing well as big tech names lead the way

Overall in Morgan Stanley’s analysis, growth stocks still lead the factor race when considering the wider market, up 8.9% on a risk-adjusted basis year over year. Those stocks where valuation factors such as price to earnings or price to book are not the key performance driver are dominated by the technology sector. Of the top ten growth stocks in Morgan Stanley’s analysis, six are technology related, with Alphabet, Amazon, Facebook making up the top three respectively.

Leave A Comment