Here is an economic data point that you will not hear about in the mainstream financial media: U.S. wage growth in 2017 had been the weakest since 2010. In fact, labor costs rose a paltry 0.35% on a year-over-year basis.

Are higher wages for workers, then, right around the bend? Some believe that the tighter labor market is about to spark wage inflation. Yet it seems that this could be wishful thinking. Actual inflation has shown up in housing costs (e.g., rent, repairs, etc.), groceries and medical care, less so in employee pay.

Might recent tax reform lead to higher employee compensation? It is possible, but not necessarily probable.

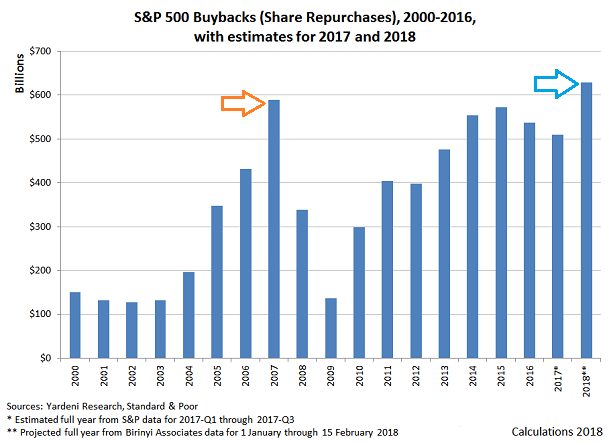

Consider corporate announcements in 2018. Plans to buy back shares of stock have surged 22%. In contrast, plans for capital expenditures – the acquisition, upgrading or maintenance of property, equipment, plants and so forth – rose a meager 3%. It stands to reason that, if companies have limited interest in “CapEx” investment for longer-term growth, then they may not be particularly eager to invest in human resource retention and development.

Granted, the wave of stock buybacks set to hit financial markets throughout 2018 may keep stocks from cratering. They’ve been a tremendous tailwind throughout the 9-year bull. On the other hand, the last time corporate buybacks rocketed to all-time highs was in 2007 – the year that the financial crisis began.

One question that investors may wish to ask themselves is whether or not wage gains will be strong enough in the months ahead. Why? With the average American’s credit card balance as a percentage of real disposable income more than DOUBLE his/her real savings, wage gains will be necessary to keep the spending spree alive. Remember, personal consumption represents 70% of U.S. economic growth.

High credit card balances and low saving rates notwithstanding, the combination of tax cuts and wage gains may be potent enough to bolster consumer spending in the near-term. Still, how long would it take before higher borrowing costs force households to use any additional monies to pay down debt?

Leave A Comment