Since the Great Recession, each time that the U.S. economy bogged down, the U.S. Federal Reserve began printing additional electronic dollar credits to acquire billions in assets (a.k.a. “quantitative easing” or “QE”). And the efforts were primarily responsible for pushing interest rates lower, as well as stock and real estate prices higher.

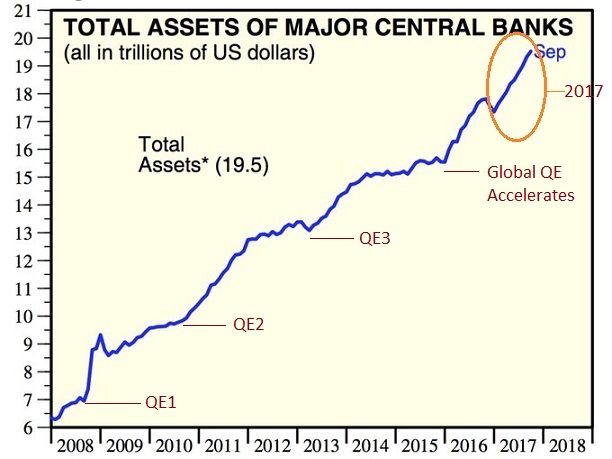

Take a look at the blue line in the chart below. It represents the electronic money printing activity of central banks across the world. Not only did stocks surge ahead at every U.S.-inspired QE juncture (e.g., QE1, QE2, QE3, etc.), but globally coordinated QE activity actually accelerated in 2016 and 2017. (See the orange oval.)

More than anything else, including the prospect for U.S. tax reform, stock price appreciation has been a function of central bank monetary credits ending up in riskier assets (e.g., stocks, bonds, etc.). On the other hand, global QE is set to decelerate dramatically in 2018. For example, our Fed is stopping the reinvestment of electronic money credits into new asset purchases and the institution plans on eliminating $420 billion from its balance sheet. Similarly, the European Central Bank (ECB) is slowing down its acquisition of below-investment-grade corporate bonds in its tapering process; they’re going to be removing $500 billion in “accommodation.”

The removal of nearly $1 trillion in asset price support in 2018 is hardly insignificant. Over the last nine years, stock price appreciation has been robust when the slope of the blue line above has steepened. In contrast, stocks have tended to struggle in periods when the slope of the blue line flattened.

Researchers at Bank of America have elaborated on the analysis. They identified each market shock since the start of 2013. In so doing, they found that central banks like the Fed intervened to protect markets in every instance up until the Brexit vote. Ironically enough, since the Brexit vote in July of 2016, investors have conditioned themselves to expect the central bank backstop (a.k.a. “Fed put”) and to buy every market dip.

Leave A Comment