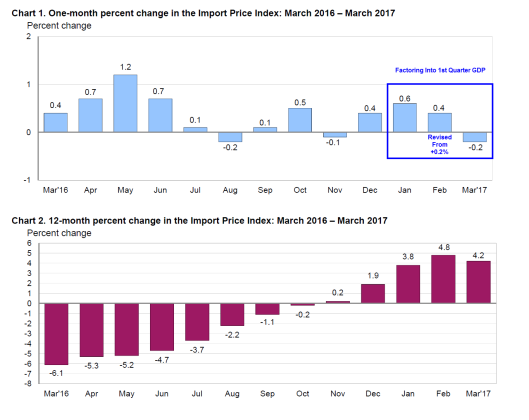

The BLS report on Import and Export Prices shows prices of imports declined 0.2% in March following increases in each of the 3 previous months.

Export prices rose 0.2%. This was the seventh consecutive increase in export prices.

On the surface, this appears to be very good news for first quarter GDP but February revisions took away half of the gain.

Import Prices

All Imports: Import prices fell 0.2 percent in March, after increasing 1.4 percent over the previous 3 months. Prior to the March downturn, import prices trended up over most of the past 12 months, advancing 4.2 percent between March 2016 and March 2017. In contrast, import prices fell 6.1 percent for the previous 12-month period.

Fuel Imports: The price index for import fuel declined 3.8 percent in March, the largest 1-month drop since the index fell 6.8 percent in February 2016. In March, a 3.6-percent decrease in petroleum prices and an 11.0-percent decline in natural gas prices contributed to the overall fall in fuel prices. The March decrease in petroleum prices was the largest monthly decline since the index fell 4.1 percent in August, and the drop in natural gas prices was the largest 1-month decrease since the index declined 20.0 percent in March 2016. Despite the March downturn, the price index for import fuel increased 50.2 percent over the past year, after declining 36.7 percent the previous 12 months. The March 2017 over-the-year increase was driven by a 52.1-percent advance in petroleum prices and a 53.8-percent rise in natural gas prices.

All Imports Excluding Fuel: In contrast to fuel prices, prices for nonfuel imports increased in March, rising 0.2 percent. The advance followed a 0.4-percent rise in February and was led by higher prices for nonfuel industrial supplies and materials and capital goods. Those increases more than offset falling prices for consumer goods and foods, feeds, and beverages. The price index for nonfuel imports advanced 1.0 percent over the past 12 months, the largest over-the-year advance since the index increased 1.3 percent in April 2012. The increase from March 2016 to March 2017 was driven by higher prices for nonfuel industrial supplies and materials and foods, feeds, and beverages, which more than offset 12-month declines for each of the major finished goods categories.

Leave A Comment