The Battle Between Inflationary and Deflationary Forces

At the meeting of the Incrementum Fund’s Advisory Board in early October, there was once again a wide-ranging and in-depth discussion of the economy and financial markets in light of the increasingly evident tensions between the forces of deflation and the countervailing inflationary measures taken by central bankers all over the world.

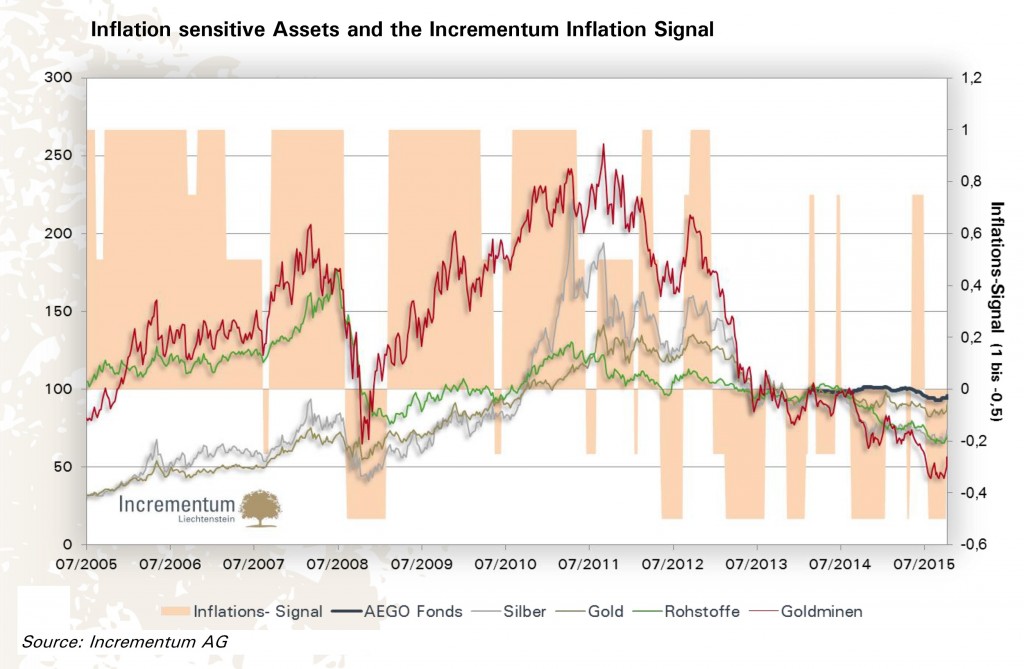

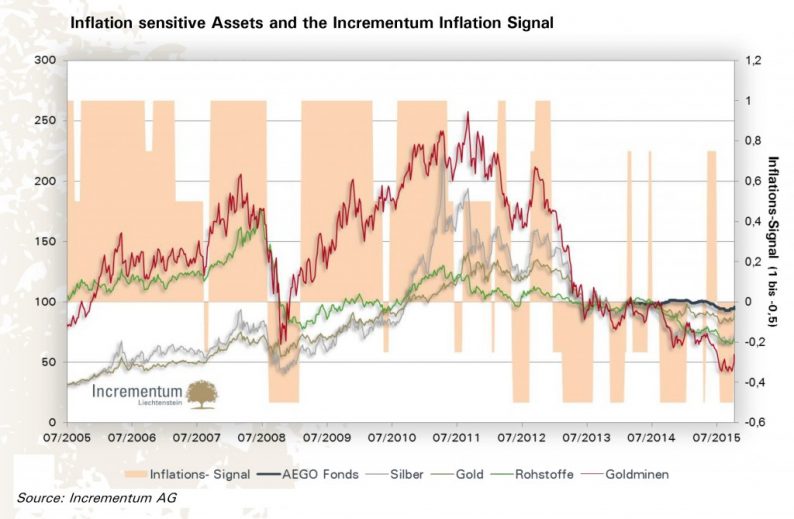

The proprietary Incrementum inflation signal vs. inflation-sensitive assets – click to enlarge.

Over the past year the first cracks in the post GFC echo bubble have become increasingly visible, with the big downturn in China’s stock market, the ongoing collapse in commodity prices and emerging market currencies and beginning weakness in junk bonds.

Everything points to the situation becoming even more “interesting” (in the Chinese curse sense) over coming months.

China’s money supply growth (M1 and M2) continues to weaken – click to enlarge.

Regular readers of this blog will be familiar with many of the topics that were discussed, as we often write about them in these pages as well. The quarterly debate of the advisory board in addition to this provides the perspective of Ronald Stoeferle and Mark Valek (the managers of the fund), as well as board members Zac Bharucha, Dr. Frank Shostak, Rahim Taghizadegan and Jim Rickards.

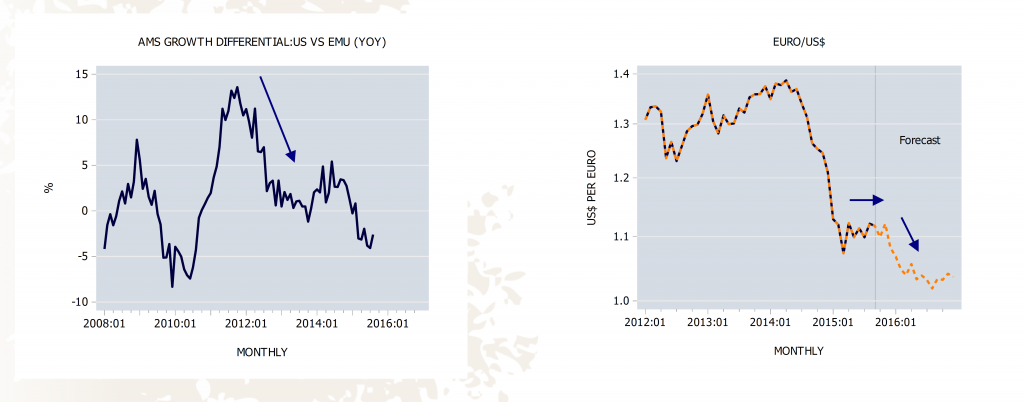

Money supply growth differential between the US and the eurozone and the EURUSD rate, from Dr. Shostak’s October AAS FX report – click to enlarge.

The transcript of the discussion can be downloaded here (pdf).

Charts by: Incrementum, ASE, St. Louis Federal Reserve Research

Leave A Comment