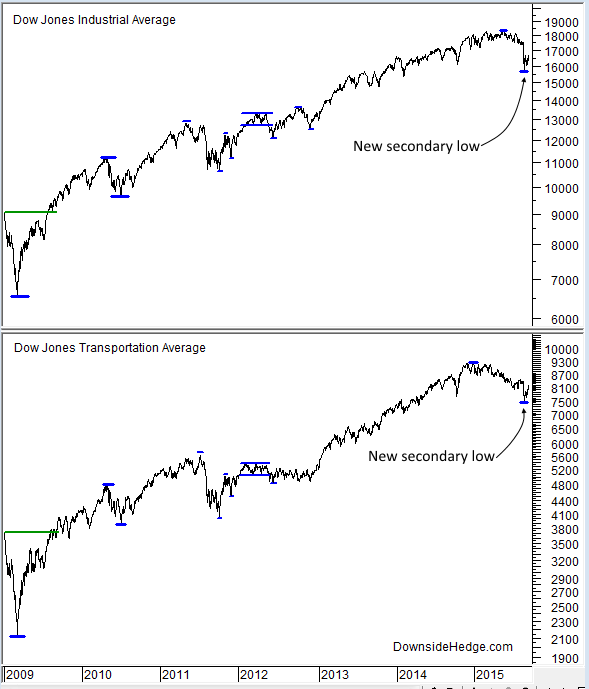

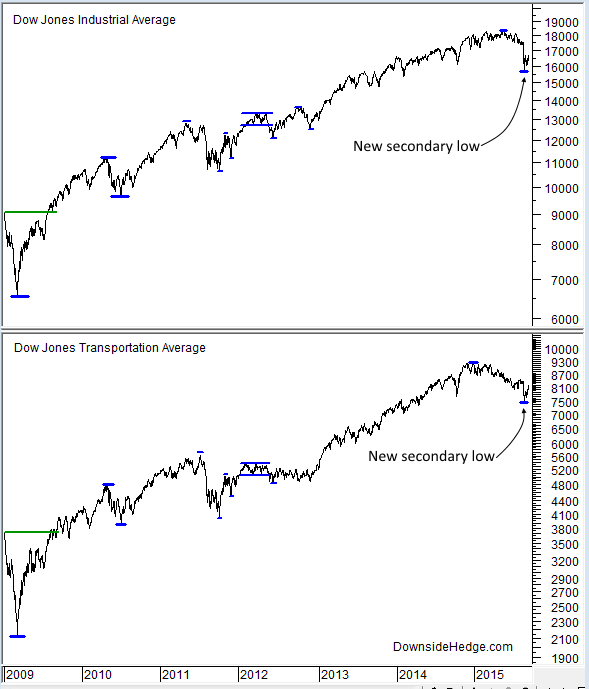

Today the Dow Jones Industrial Average (DJI) completed the work it needed to do for a new secondary low to be marked. It joins the transports (DJT) which completed the low pattern yesterday. This is a significant event given the fact that it’s been almost three years since Dow Theory lows have been made. We now have a reference point that is only 6% to 9% below current levels (DJIA and DJTA respectively) that will signal a new bear market is upon us if they are broken.

But, until the August lows are broken the long term trend is considered bullish. According to Dow Theory you should use the current dip to accumulate more stock. What!!? Yes, according to Dow Theory you should time your purchases with secondary lows…and that means buying this dip. The idea is that you’re buying a dip with a clear sell stop that is only 6% below DJIA. If you had followed this methodology from the last Dow Theory bull market signal in the summer of 2009 you would have accumulated a lot of stock while DJIA was between 9000 and 13,500. This should make it much easier to put some new money to work just in case there’s more rally ahead. If instead, the market turns back down and DJIA closes below 15,655 you’ll have extremely high odds that the bull market is over. With a new bear market in place you’ll then be looking to sell into rallies (or wait in cash if you don’t like trading from the short side).

I’m sure some of you are now saying to yourselves, “Um, but your portfolios are aggressively hedged. Why are you now saying this is a dip to be bought?” The difference between my portfolio allocations and Dow Theory is the time frame. My portfolio allocation methods are based on intermediate term indicators and Dow Theory is designed to catch the very long term trend. Currently my market risk indicator is signalling and all of my core health indicator categories are negative. This means the odds are high the intermediate term trend is down so I’m hedged just in case the long term trend is down as well. Since the long term trend is still bullish I’m more likely to take profits from the hedge quicker and rebalance more often (buying the dip with hedge profit). If Dow Theory signals that a bear market has begun it will make it much easier for me to maintain the hedge and wait for significant dips to take profit and rebalance.

Leave A Comment