Inflation. Deflation.

Two words often heard in conversations about the bond market.

Why?

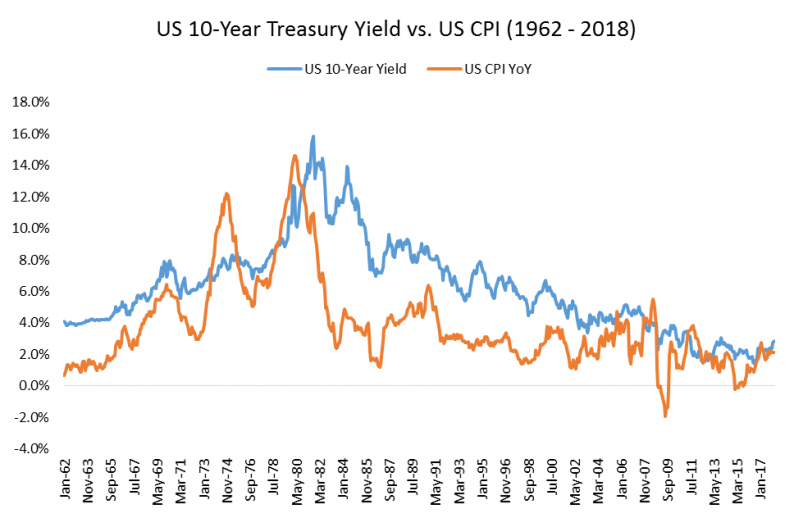

Because bond investors tend to demand higher yields in periods of higher inflation and lower yields in periods of lower inflation or deflation.

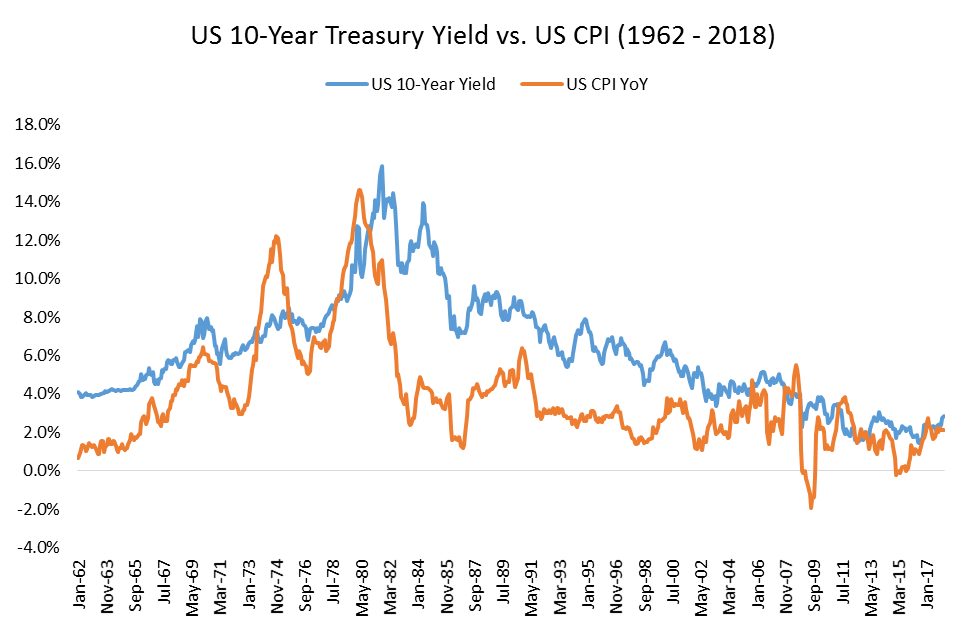

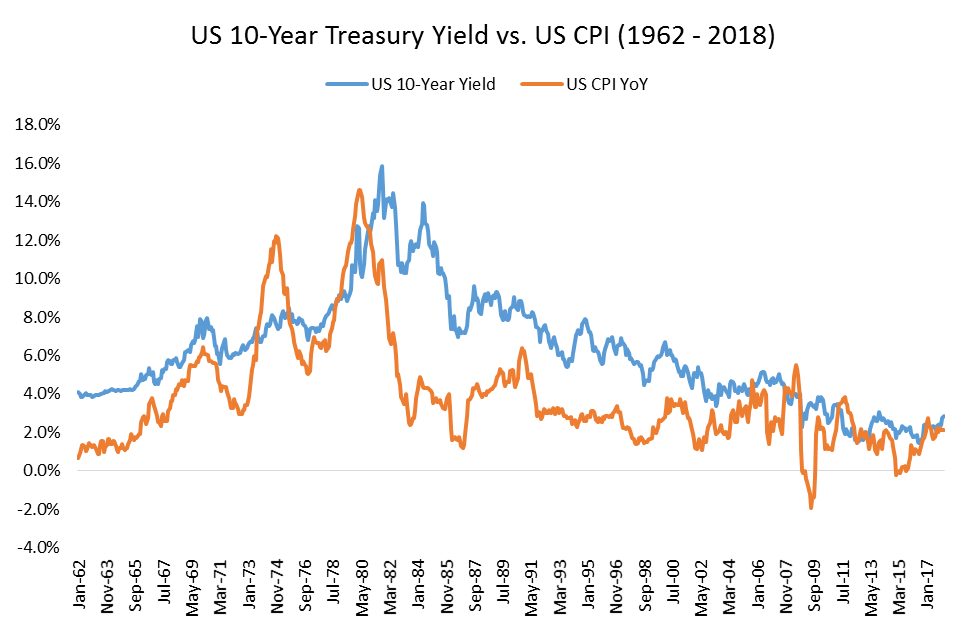

Looking at a long-term chart of yields and inflation, the relationship is clear.

Data Source: Federal Reserve Economic Data (FRED).

Not as clear from this chart is how bonds have actually performed during various levels of inflation. What has been the best environment for bond investors historically: high inflation, low inflation, or something in between? To answer that question, we need to take a closer look at the data.

Bond Returns During Various Inflation Regimes

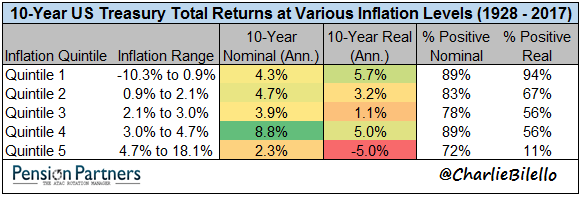

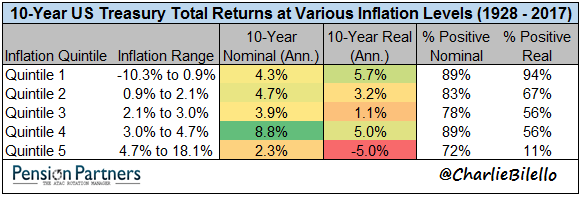

If we segment calendar year changes in the Consumer Price Index (CPI) into quintiles, we observe the following:

The lowest nominal and real bond returns in high inflation environments (quintile 5).

The highest real bond returns in low inflation environments (quintile 1).

The highest nominal bond returns in periods of moderate inflation (quintile 4).

Data Source: BLS, Stern.NYU.edu/~adamodar

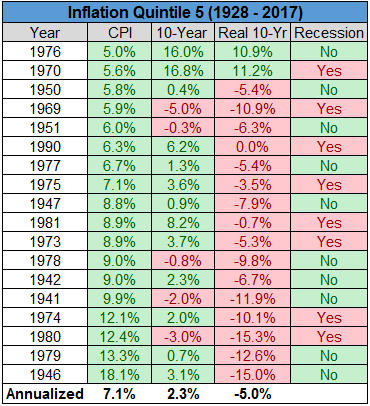

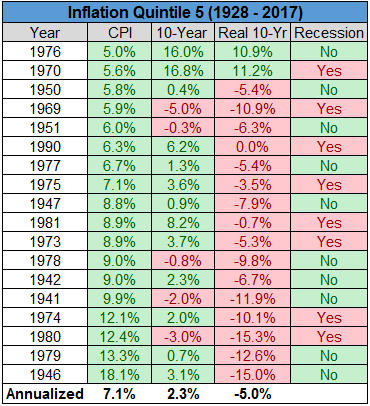

During years with the highest inflation (quintile 5):

Bonds generated their lowest nominal returns, 2.3% on average.

Many of the years represented in this quintile occurred during the 1970s (1970, 1973, 1974, 1975, 1976, 1977, 1978, and 1979) and early 1980s (1980, 1981).

Rising interest rates during this period (6.2% 10-year in 1969 to 15.8% 10-year in 1981) proved to be a significant headwind. When combined with high inflation, this resulted in the lowest real bond returns (-5.0%) of any quintile with only 11% of years showing a positive real return.

Data Source: BLS, Stern.NYU.edu/~adamodar

During years with the lowest inflation (quintile 1):

Bonds generated an annualized return of 4.3% with 89% of years posting a positive return. The real bond returns in this quintile, at 5.7%, were higher than the nominal returns due to negative annualized CPI.

Many of the years represented were during the Great Depression (1929, 1930, 1931, 1932) and the subsequent decade (1938, 1939, 1940). Deflation was the great concern during this period and bonds would act as one of the best preservers of wealth.

While nominal yields were low in this period, falling interest rates from 1929 (3.6% 10-year) to 1941 (1.95% 10-year) provided a tailwind to bond returns.

Leave A Comment