Inflation – Income Growth Misses Estimates & Inflation Meets Them

Personal income growth in the September PCE report came in at 0.2% on a month over month basis. It missed the consensus for 0.4%.

Stripping out taxes, real disposable income growth was 0.1%.

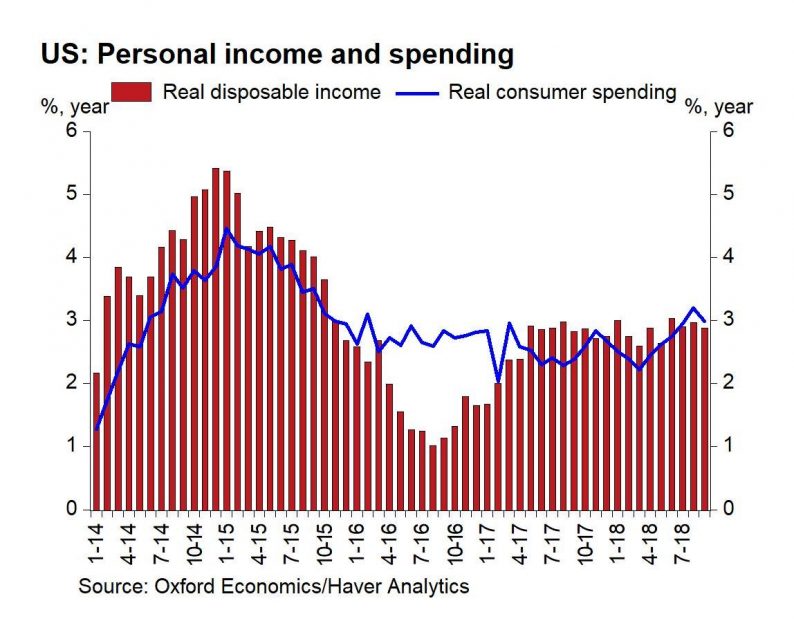

As you can see from the chart below, year over year real disposable income growth was 2.9%. It supported real consumer spending growth of 3%.

Since spending growth was faster than income growth, the savings rate fell to 6.2% which is the lowest rate since December 2017. On a month over month basis, consumer spending growth was 0.4% which met estimates.

Spending on durables was up 1.4% month over month. It may have been helped by the vehicle replacement demand caused by hurricane Florence.

Next month will have the same spike because of hurricane Michael. Spending on non-durables was only up 0.3%.

Inflation Matches Estimates & The Fed’s Target

The headline PCE price index was up 0.1% month over month which matched estimates. It was up 2% year over year. That met estimates and was down from 2.2% last month.

Headline inflation will likely fall further in October. Oil prices have plummeted along with the overall market.

Technically, the Fed says it follows headline PCE inflation. However, in action, the Fed always seems more concerned with core PCE.

We’re in an unusual situation where core and headline inflation were the same at 2%. This is also the Fed’s goal. It’s the rare perfect inflation report for the Fed.

As you can see from the chart below, core PCE has been steadier than core CPI. On a month over month basis, core PCE was up 0.2%. That beat estimates for 0.1%.

Even though inflation matched expectations, the expectations for rate hikes in 2019 have fallen. This is because of the ‘risk off’ trade.

All stock market declines don’t affect the Fed funds futures market. But once stocks fall over 5%, it’s fair to expect the market to price in fewer rate hikes.

Leave A Comment