Insider buying declined last week with insiders buying $27.94 million of stock compared to $56.58 million in the week prior. Selling on the other hand increased with insiders selling $267.17 million of stock last week compared to $112.27 million in the week prior.

The S&P 500 rallied 1.75% last week after we saw insider selling drop to its lowest level in four years. While the rally was broad based, we saw big increases in some long suffering energy names as you can see from the 34% gain in Consol Energy (CNX) and the nearly 10% gain in Kinder Morgan (KMI) in the chart below.

Pull back the curtain a year and this rally pales in comparison as Consol is down nearly 74% and Kinder Morgan is down more than 60% despite the recent rally. We have highlighted insider purchases in both these names in the past. As is often the case with insiders and value investors, it was a case of “premature accumulation”. Where we go from here is anyone’s guess but the the 9.38% drop in the S&P 500 doesn’t even begin to paint the picture of how much some segments of the market like energy, commodities and young technology companies have dropped in the last six months. For the prudent investor who is willing to put in the time to do detailed bottoms-up analysis, there appear to be interesting opportunities amongst these beaten down names if you can navigate the dangerous currents of value traps masquerading as value stocks.

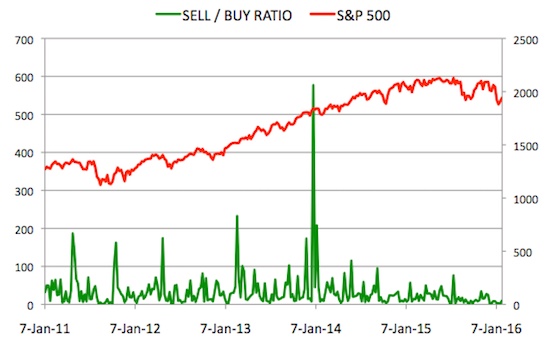

Sell/Buy Ratio: The insider Sell/Buy ratio is calculated by dividing the total insider sales in a given week by total insider purchases that week. The adjusted ratio for last week went up to 9.56. In other words, insiders sold almost 10 times as much stock as they purchased. The Sell/Buy ratio this week compares unfavorably with the prior week, when the ratio stood at 1.98. We are calculating an adjusted ratio by removing transactions by funds and companies and trying as best as possible only to retain information about insiders and 10% owners who are not funds or companies.

Note: As mentioned in the first post in this series, certain industries have their preferred metrics such as same store sales for retailers, funds from operations (FFO) for REITs and revenue per available room (RevPAR) for hotels that provide a better basis for comparison than simple valuation metrics. However metrics like Price/Earnings, Price/Sales and Enterprise Value/EBITDA included below should provide a good starting point for analyzing the majority of stocks.

Notable Insider Buys:

1. Kinder Morgan, Inc. (KMI): $16.45

Director Michael C. Morgan acquired 180,000 shares of this oil & gas pipelines company, paying $14.20 per share for a total amount of $2.56 million. These shares were purchased indirectly by Portcullis Partners, LP.

You can view the list of recent insider transactions for Kinder Morgan, Inc. here.

Leave A Comment