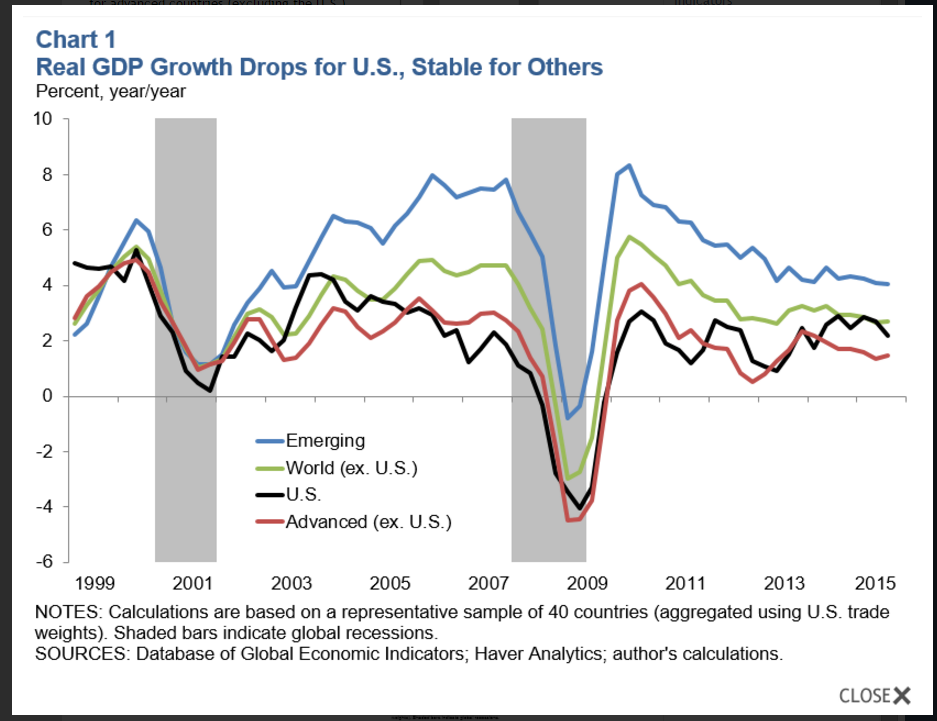

The Dallas Fed published its international economic review this week, which contained the following graph of global economic growth:

Since 2013, emerging, world and advanced economies’ GDP growth continued to move slightly lower. The only economy to gain GDP traction was the US. The report also contained a graph of global inflation:

Here, all major regions are experiencing a downturn in prices, but this time since 2011. There is little new in this information; we’ve known for some time that overall, the global economy is somewhat weaker over the last 12-24 months. But as we near year end, these two charts provide and important reminder that the global situation is delicate.

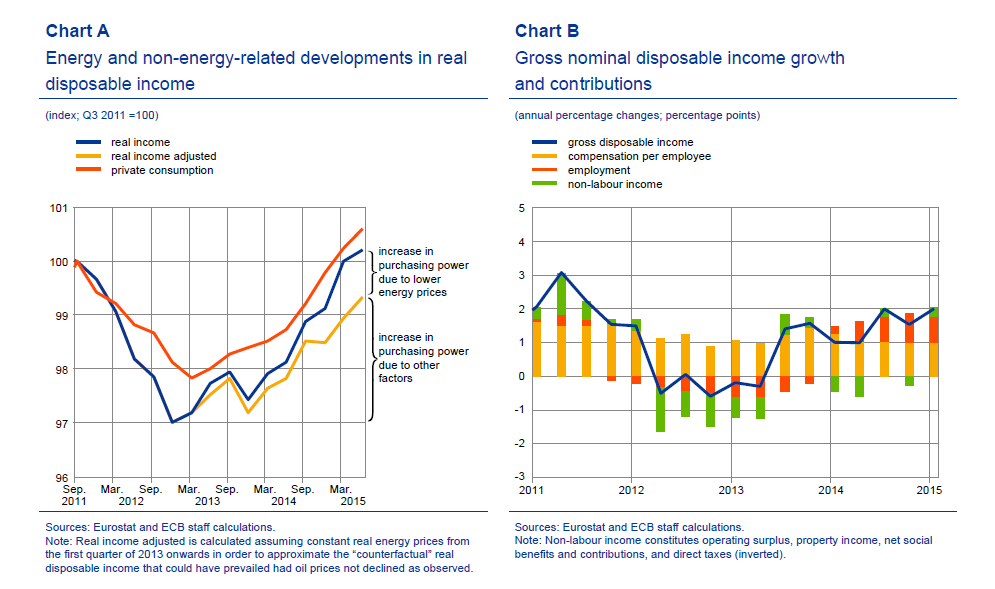

EU news continues to show a growing region. The latest ECB report explained that wages were increasing due to lower fuel prices and improving employment:

The left graph shows that lower energy prices are responsible for ~1/3 of the improved consumer buying power. The right graph shows that employment growth and compensation are about equally responsible for the remaining increase. The recently reported employment increase should add to wage gains:

The number of persons employed increased by 0.3% in the euro area (EA19) and by 0.4% in the EU28 in the third quarter of 2015 compared with the previous quarter, according to national accounts estimates published by Eurostat, the statistical office of the European Union. In the second quarter of 2015, employment increased by 0.4% in the euro area and by 0.3% in the EU28. These figures are seasonally adjusted.

The industrial sector remains strong: industrial production increased 1.9% Y/Y while Markit reported the highest flash manufacturing number (54.4) in 20 months. Services were also healthy with a 53.9 reading. There are still problems, however. Total inflation increased a mere .2% Y/Y. The core rate was somewhat better at .9%, but that figure is still low. And in a speech earlier this week, ECB head Draghi highlighted the EU region’s anemic investment growth:

Leave A Comment