Who would have thought a beaver could run faster than an eagle?

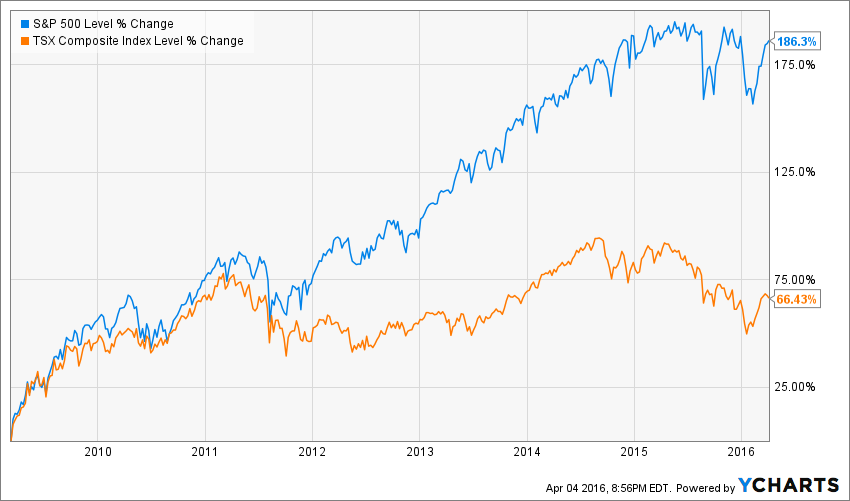

You might want to say that it’s only one quarter and that the Canadian stock market has been beaten up nicely by the US stock market for the past… well I don’t remember since when, but let’s just say that you should never bet against America ;-). If you still have doubt, let’s just take a look at how both markets have performed since the 2008 crash:

Source: Ycharts

But recently, the Canadian stock market has been showing some very interesting perspectives. After all, yesterday’s winner is probably not the horse you should bet on today!

Why the Canadian Stock Market is The Best Place to Be Now

I don’t write this because I’m Canadian. In fact, I was heavily invested in US stocks between 2012 and 2015 and this had served me well. However, in this beginning of 2016, I found several very interesting companies to purchase (RY, AGU, CNR, EMA) on my side of the border. I guess the first reason for buying Canadian stocks at the moment is the chances of seeing the currency much weaker than this is almost impossible (especially when we hit 1.45 exchange rate!). But I’m not a big believe in fx rate bets over the long run. I have other reasons to believe the Canadian stock market was the best place to invest my money right now.

Hidden Gems in the Canadian Market

My favorite saying about investing is:

“The time to buy is when there’s blood in the streets.”

Baron Rothschild

Well when the TSX over lost 20% between April 2015 and January 2016, I call for the bloody street:

Source: Ycharts

While the stock market is in a pretty hectic mood, this is the perfect time to invest. What I find particularly interesting at the moment is that most of this important drop is related to the collapse of oil prices. However, believe it or not, the Canadian stock market is more than an oil market. The best proof I can give you is the fact that even though it’s been a very tough 2 years for the oil industry, Canada hasn’t entered a recession yet. Unless you take the recession definition to the letter (exactly 2 consecutive quarters of negative GDP growth), the Canadian economy has been able to keep its head above water over the past 2 years. The services sector and exports had taken the lead and now that oil prices are gaining some strength, we can see there are several opportunities.

Leave A Comment