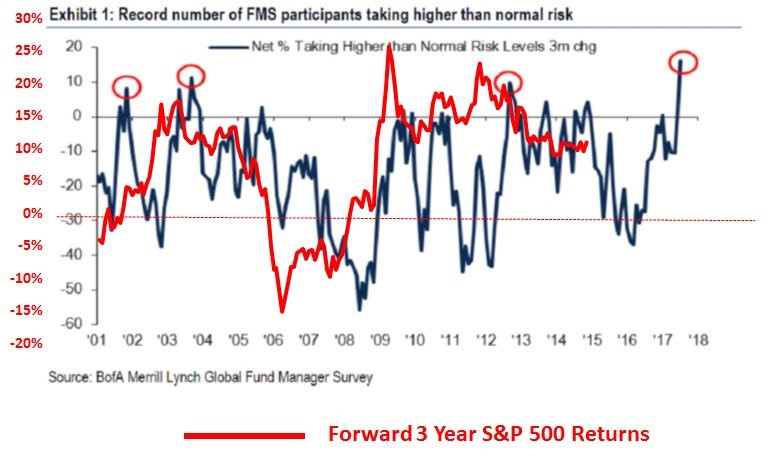

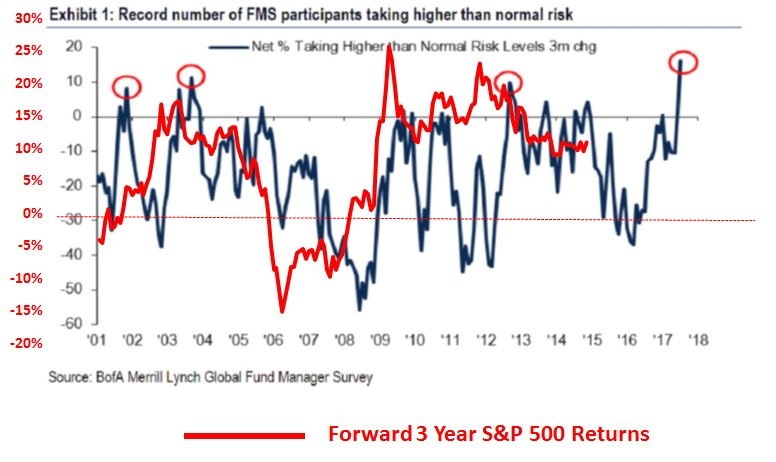

Actually Returns Are Good When Fund Managers Are Taking Risk

In a previous article, I showed the chart below without the 3 year forward S&P 500 returns. Some bears were claiming the fact that fund managers are taking more risk than ever meant impending doom. As I mentioned, there have been times when the fund managers were very bullish and stocks did well afterwards. The red line supports this point. As you can see, the returns were high 3 years after fund managers were very bullish in 2003, 2009, 2010, and 2013. The takeaway is that this optimism from fund managers doesn’t necessarily mean stocks will crash soon. It’s important to avoid being persuaded by the title of a chart. Instead analyze it in a non-biased fashion to get a better idea of what it says.

Despair From A 1% Fall

The S&P 500 is down 1.15% from its all-time high on November 8th; the bears are celebrating. This would be a normal few days if we weren’t in 2016 or 2017. Shockingly, this is the biggest selloff in about 3 months. It’s tough to draw any conclusions from such a small move. The chart below shows the Bloomberg Fear/Greed index. It must be very sensitive to movement because it has already switched to showing fear as it tests its 50 day moving average. The other popular Fear & Greed Index is put out by CNN. I’ve followed that one for a few years. It shows a 49 reading on a scale of 1 to 100, meaning the market is neutral. This is the lowest reading in a few months. As I mentioned a few times in previous articles, these sentiment readings can crater after small moves. If you are a short term trader, capturing this decline is profitable meaning you should follow these indexes. If you’re a long term investor, these signs of modest fear are great. It means the market doesn’t have much euphoria. I have been talking about how the biggest concern this year is the lack of any pullbacks. If this selloff turns into a 5% correction, that would be a great buying opportunity.

Leave A Comment