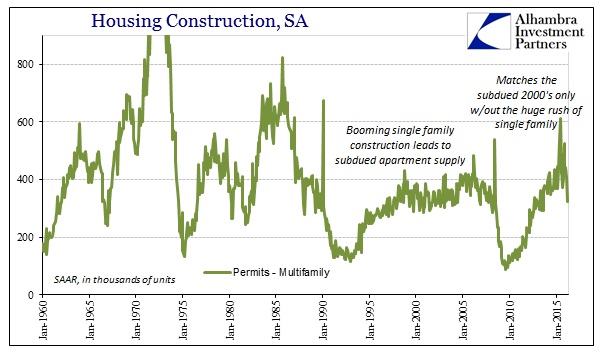

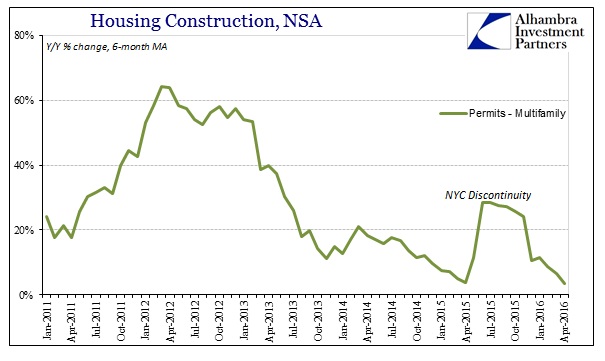

Home construction estimates continue to suggest the same kinds of economic imbalances unchanged from last year. While construction of single family homes had been rising, that increase was not nearly as widespread and voluminous to indicate that the real estate market had been restored by full economic restoration (jobs, jobs, jobs). Apartment construction, on the other hand, has been scaled back significantly of late. Multi-family permits had dropped to just 318k SAAR in March from above 500k as late as November. At barely more than 300k, it was the lowest indication of future apartment construction since the summer of 2013. There was only a minor rebound in April to just 348k.

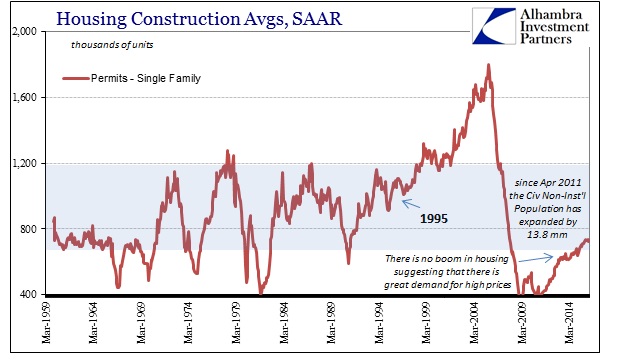

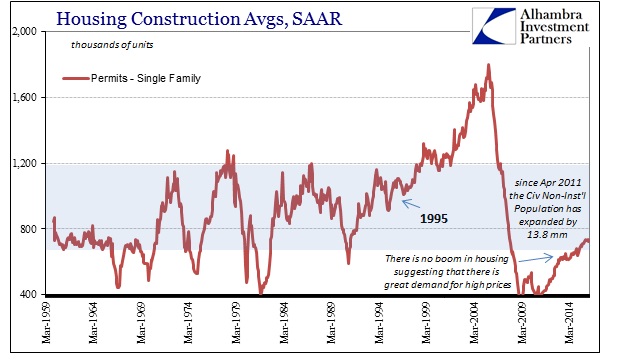

If we assume that the narrative about the single family market is true, meaning that upper level homes are selling but those in the lower tiers are not because of pricing (or mortgage availability) rather than economy, then we should expect either a burst of construction in the single family units or apartments (or both). If the economy is strong and getting more so by the month, then household formation would demand after six or seven years of depressed supply a rush of activity far beyond the lower levels of the historical range in each. The Civilian Non-institutional Population, the potential supply of new labor, expanded by almost 14 million since April 2011 when the housing market started to turn around. That alone argues for a significantly higher pace to construction.

Instead, as you can see immediately above, the only big burst of activity off the bottom was in the early years under the auspices of the QE’s. The construction mini-bubble slowed in 2013 during the precursor episode to the “rising dollar” and never really regained that prior optimism. That, along with the subdued nature of the single family market, does not argue for a strong economy.

In more immediate terms, the reduction in activity since last autumn might only be a temporary pause in that restrained pace, but it might also signal a potentially dramatic shift in financial conditions. How many marginal apartment projects have been funded by leveraged loans? Or junk bonds? If there is a financial component to the current decline in construction indications, you would expect that diminished future “supply” to increase the prices of existing units.

Leave A Comment