Last week, one of the curious parts of the CPI report was the large jump (1.6% month/month, or nearly 20% annualized) in Apparel. At the time, I dismissed this rise with a hand-wave, pointing out that it Apparel is only 4% of core and so I don’t worry as much about Apparel as I do, say, Medical Care or Housing.

But a Twitter follower called to my attention the words of @IanShepherdson, one of the real quality economists out there (and one whom I read regularly when he was with High Frequency Economics, and I was at Natixis). He hasn’t always been on top of the inflation story, but he nailed the housing bubble story in 2008 and I have great respect for him. Ian apparently said of Apparel that it could be the proverbial “canary in the coal mine” when it comes to inflation, since apparel tends to respond more quickly to inflationary pressures since it is a very competitive and very homogeneous category.

So I figured it was worth taking a longer look at inflation.

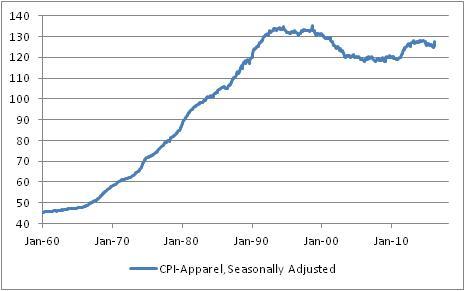

Now, I should point out that I probably have a bias about getting over-excited about inflation. Back in 2011-12, Apparel prices started to accelerate rapidly for the first time in a generation- and that’s no hyperbole. As the chart below (Source: Bloomberg) shows, the price index for seasonally-adjusted apparel prices went sideways-to-down-to-sideways between 1992 and 2012.

You can see from this why I may have gotten excited in 2012. Between 1970 and 1992, apparel prices rose at a very steady rate. Then, as post-Cold War globalization kicked into high gear, apparel manufacture moved from being largely produced in the US to being largely produced outside of the US; the effect on prices is apparent on the chart. But in 2011-2012, the price index began to move higher at almost the same slope as it had been moving prior to the globalization dividend. My thought back then was that the dividend only happens once: at first, input costs are stable or declining because high-cost US labor is replaced with low-cost overseas labor – but eventually, once all apparel is produced overseas, then the composition effect is exhausted and input prices will rise with the cost of labor again. In 2012, I thought that might be happening.

Leave A Comment