Hewlett-Packard Company (HPQ) Information Technology – Computers & Peripherals | Reports May 19, After Market Closes

Hewlett Packard is scheduled to report fiscal second quarter earnings tomorrow, after the market closes. Mixed results from Intel and other PC centric companies this season could indicate bad news for HP. The tech company is coming off a FQ1 2016 that missed EPS expectations, after 7 quarters of beating or meeting. The real story however, is the massive downturn in comparisons the company has experienced. The past 2 quarters featured over 50% declines on both the top and bottom line with upcoming earnings shaping up to be more of the same.

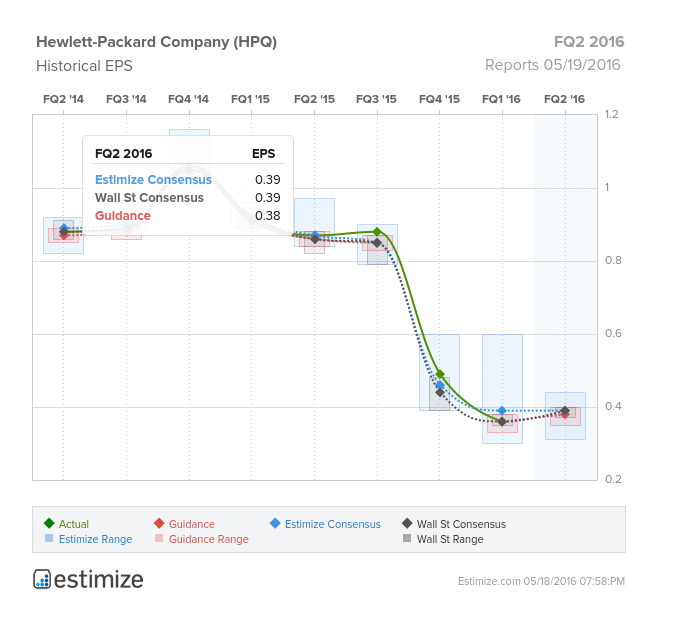

The Estimize consensus is calling for earnings per share of 39 cents on $11.87 billion in revenue, right in line with Wall Street on the bottom and $40 million higher on the top. Since HP’s last report, per share estimates have come down 32% to reflect a 55% decline from a year earlier. Revenue, on the other hand, is forecasted to fall 53% over that time frame. Given its recent history, it’s not surprising that shares are down nearly 25% in the past 12 months. Fortunately, shareholders will be able to reconcile some of their losses as the stock is typically a positive gainer during earnings season.

Hewlett Packard, is best known as a manufacturer of laptops, desktops, printers and electronic accessories. Its PC centric portfolio has suffered lately as personal computers continue to see decreasing demand and sales. The ongoing weakness in the PC market was reverberate throughout Q1 when many other PC focused companies reporting below expectations. This should remain an issue moving forward with currency headwinds and macroeconomic volatility also causing problems.

HP is expanding into new industries in an attempt to drive growth and offset the losses after spinning out HP enterprise. HP recently announced it will introduced two 3D printers in collaboration with businesses such as BMW and Nike. The price of one printer is estimated at above $100k, putting it well out of reach for most consumers and small businesses. Meanwhile, HP is looking at opportunities to enter more buzzworthy tech areas such as virtual reality and artificial intelligence. Based on how earnings have come in over the last two years, coupled with ongoing weakness in the PC market, it’s a safe bet to steer clear from HPQ this quarter.

Leave A Comment